Build credit on your rent for free

Join thousands of Canadians who are seeing an improved credit score by reporting their rent to Equifax.

No landlord participation needed

As featured in

No landlord participation needed

Designed build your credit using the same rent you're already sending your landlord every month.

How it works

Reporting your rent is as easy as simply paying your rent.

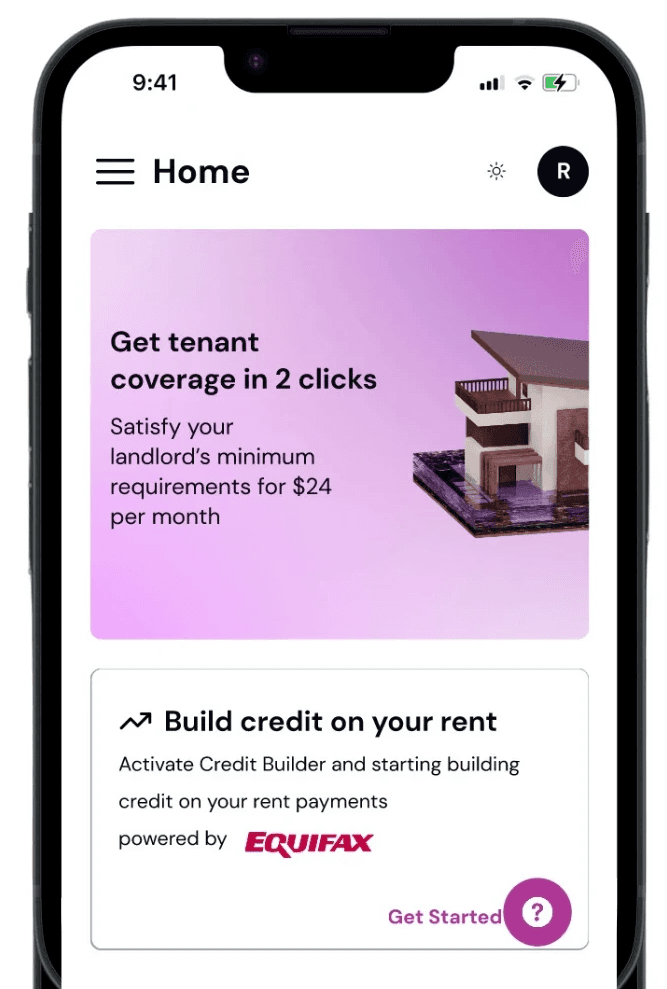

Activate & Opt-in

We'll Report

Your card will be charged monthly, and we’ll report your rent payments to Equifax. These will appear as a new tradeline on your credit report, highlighting your responsible payment history.

Build Credit

Add on

Credit Builder

Build your financial future. One rent payment at a time. For FREE.

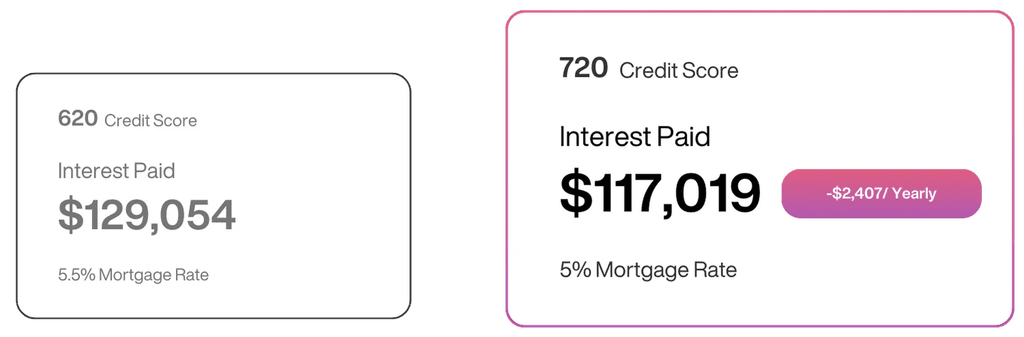

Get better rates on mortgages and car loans

Dreaming of a new car or home? A better credit score can lead to lower interest rates, saving you thousands.

Stronger rent applications

Make your rental applications stand out with a history of timely rent payments.

Improve your

Payment history

Credit history length

Credit mix

Get started in 3 Steps

Add Credit Builder

After activating rent payments, enable the Chexy Credit Builder feature from your dashboard to start building credit with your rent payments.

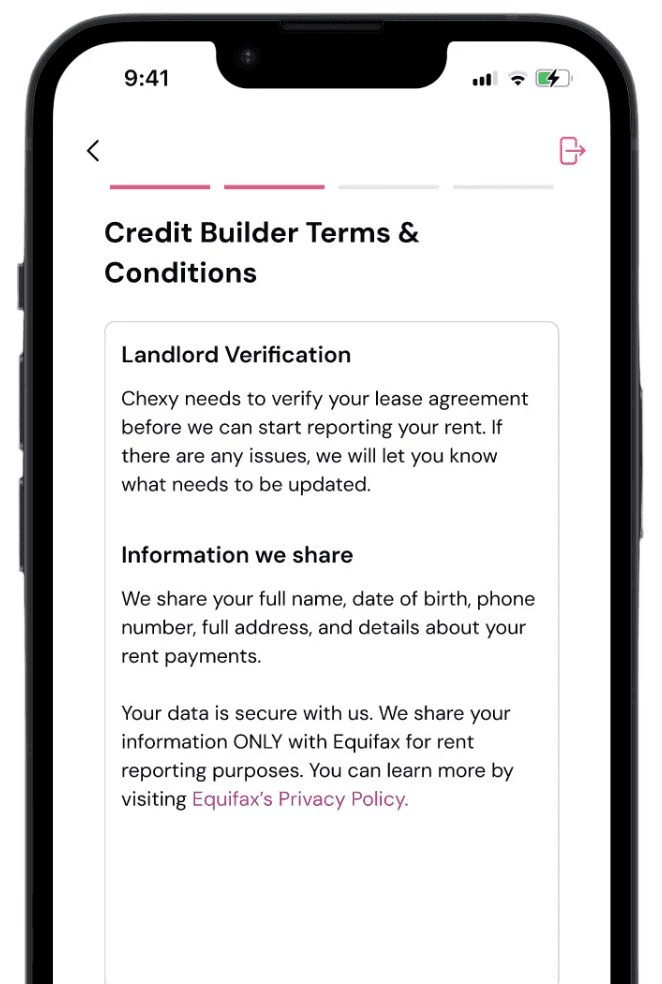

Agree to Terms & Conditions

Agree to report your rent payments to Equifax, helping you improve your credit score.

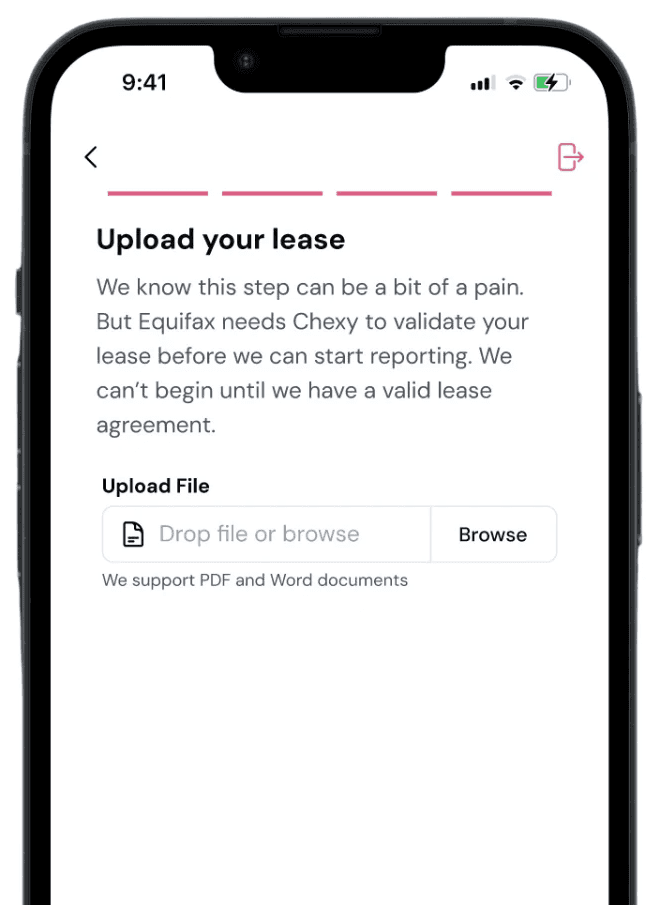

Upload Lease

Upload your lease agreement so we can validate it and begin reporting your rent payments.

Get started today and make the most of your largest monthly expense.

Rent & Build Credit

$0

/month

Set it and forget it

Get rewards*

Improve your credit score