Debunking Common Myths & Misconceptions of Credit Cards in Canada

26 juill. 2024

Written by

Written by

Brianna Harrison (Credit Card & Travel Writer)

Brianna Harrison (Credit Card & Travel Writer)

Table of contents

Title

Title

Title

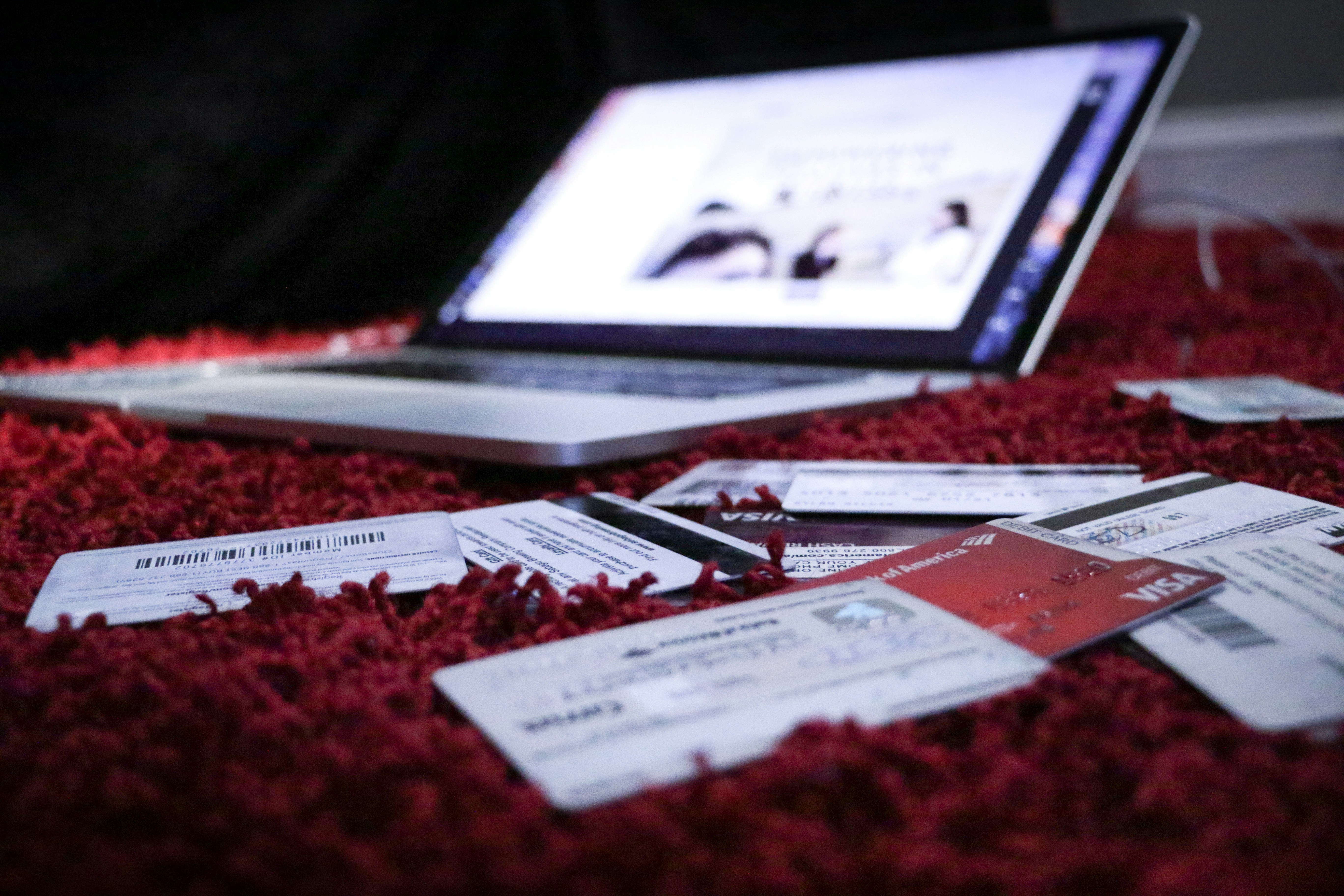

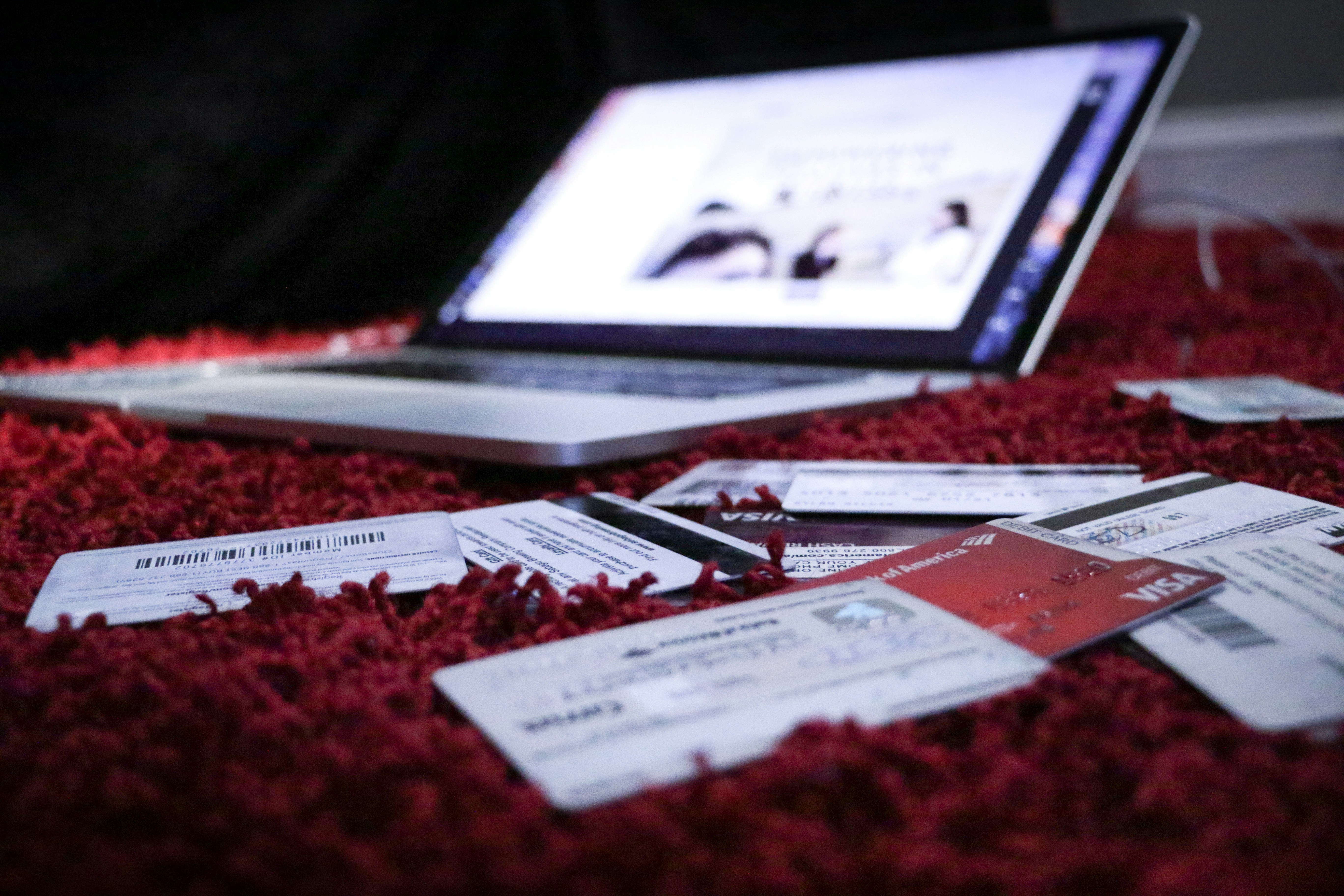

Credit cards are a widely used financial tool, yet they are often misunderstood and surrounded by myths and misconceptions. Whether you’re new to credit cards or own multiple, you’ve probably heard different opinions about them.

We’re here to debunk the most common myths and misconceptions, so you have accurate information and can make the best choices about your credit card use.

Keep reading to learn the truth about eight of the most common credit card myths in Canada.

8 Common Credit Card Myths Busted

1. Closing Unused Credit Accounts Can Improve Your Credit Score

One of the most common credit score myths is that closing accounts you no longer use can hurt your credit score. The longer the credit account has been open, the more positive impact it has on your credit score.

Cancelling your credit card reduces your available credit, which may increase your credit utilization ratio and hurt your credit score.

You should aim for a credit utilization ratio (the amount of credit you have vs. the credit you use) to be 30% or below. If you go above this, credit card companies may think you’ll have difficulty repaying what you owe.

Let’s say you have three credit cards, each with a credit limit of $10,000. To have a good credit utilization ratio, you should spend $9,000 or less. If you cancel one of those cards, your ratio will decrease to $6,000.

Closing just one account can limit how much you can spend; if you go above that, your credit score (or FICO score in Canada) can take a hit.

2. You Shouldn’t Have Multiple Credit Cards

Many people think you should avoid having multiple credit cards, as applying for new cards can significantly lower your credit score. While it is true that credit card companies check your credit with a hard inquiry, which can lower your credit score by a few points, one single inquiry won’t have a large effect on your overall credit report.

However, if you apply for multiple credit cards in a short period, all those hard inquiries will likely damage your credit score. It may seem like you’re facing financial difficulties, and you may be less likely to get approved for new credit cards.

How many credit cards should I have in Canada?

There is no hard and fast rule as to how many credit cards you should have, but according to Equifax, it’s recommended that you have two or three credit accounts open at once. If you have more than three, keeping track of your monthly payments and due dates can be difficult.

Generally, you should wait at least three to six months before applying for another credit card. This gives you time to use your other credit cards responsibly and boost your credit report once again.

3. You Can’t Get a Credit Card If You Have Bad Credit

While generally, the minimum credit score for a credit card in Canada is 660 or above (a fair to good credit score), some cards are made for those with a low credit score or no credit history. These are called secured credit cards, which require a cash deposit (which is generally your credit limit) instead of a credit check.

Secured credit cards help you build credit fast, as each timely payment is reported to the credit bureaus. This is also a great credit card for newcomers to Canada who don’t have an existing credit history.

Some secured credit cards we recommend include:

If you’re wondering how to build your credit score in Canada and want to eventually apply for higher-tier credit cards, consider paying your rent and bills with Chexy, where you can opt into the Credit Builder and report your rent payments. Each timely rent payment is reported to Equifax, one of the major credit bureaus in Canada.

Using Chexy to pay your rent with debit is another great option that doesn’t require a credit card.

4. Credit Card Annual Fees Aren’t Worth It

Credit card fees can be quite high, but in most cases, they are worth it.

Take the American Express Platinum Card, for example. It has a $799 annual fee, but it comes with so many perks, like $200 travel and dining credits, unlimited access to airport lounges, travel coverage, and more.

You don’t have to use a credit card with fees as high as this, but if you take advantage of the benefits, they highly outweigh the annual fees.

Here are some of our favourite credit cards with annual fees that aren’t too high but give you amazing perks:

Scotia Momentum Visa Infinite Card – earn up to 4% cash back on all purchases

American Express Cobalt Card – earn up to 5x Membership Rewards points on all purchases

TD First Class Travel Visa Infinite Card† – earn TD Rewards Points on every purchase, plus many travel benefits

5. You Should Carry a Balance

Many people think carrying a balance on your credit card is a good way to improve your credit score in Canada. The common belief is that having a revolving balance each month will somehow benefit their credit score; however, this is not true.

The best way to use your credit card is to pay it off in full on the due date each month. This way, you won’t carry a balance and start paying interest. When you pay off your credit card balance, you maintain a lower credit utilization ratio, which highly benefits your credit score.

6. Checking Your Credit Score Hurts It

Does checking your credit score hurt it in Canada? Short answer: no.

There are two types of credit checks: a soft inquiry and a hard inquiry.

A soft credit inquiry is when you access your credit report through your bank or a credit bureau like Equifax, TransUnion, or Borrowell. This type of credit check will not affect your credit score.

A hard credit inquiry is when credit card companies or lenders look at your credit score to determine your eligibility for the credit product you’re applying for. This type of credit check will lower your credit score by a few points.

If you are responsible with your credit cards and don’t apply for too many at once, your credit score shouldn’t be affected much, if at all.

7. You Shouldn’t Have a High Credit Limit

Credit card companies use many different factors when deciding your credit limit. Generally, it’s not bad to have a high credit limit; instead, it shows lenders that you are a low-risk borrower and trustworthy enough to pay your bills on time.

With a high credit limit, be careful to stay within your credit utilization ratio of 30% of your limit. If you remain under that and pay off your credit card balance in full each month, a credit limit increase can improve your credit score.

The only time you might want to decline a credit limit increase is if you’re worried about the temptation to spend more.

8. Credit Cards Are for Emergencies Only

Growing up, most of us were told that credit cards should only be used in emergencies. While you shouldn’t be spending more than you can afford, credit cards are convenient for large expenses, such as rent and utilities, and everyday purchases.

Many credit cards offer rewards or cashback, and as long as you pay off the balance in full by the due date, a credit card is a great tool for building credit, tracking your spending, and earning rewards.

Read more about the benefits of credit cards here.

As long as you are responsible, you can use credit cards to your advantage.

If you pay rent every month, why not use your credit card and let your biggest monthly expense work for you? With Chexy, you can pay rent and bills with your credit card and earn rewards.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

Does Borrowell affect my credit score?

Checking your credit score with Borrowell will not affect your credit report, as it is a soft inquiry. It won’t even show up to lenders when they pull your score.

What is Canada’s average credit score?

According to FICO, the average credit score in Canada is around 762, which is considered good. It has increased slowly year over year, from 757 in 2018 to 762 in 2023.

What is a bad credit score in Canada?

In Canada, a credit score below 560 is considered bad. A 560 to 659 credit score is fair, and anything between 660 and 724 is considered good, according to Equifax.

† Terms and Conditions apply.

Credit cards are a widely used financial tool, yet they are often misunderstood and surrounded by myths and misconceptions. Whether you’re new to credit cards or own multiple, you’ve probably heard different opinions about them.

We’re here to debunk the most common myths and misconceptions, so you have accurate information and can make the best choices about your credit card use.

Keep reading to learn the truth about eight of the most common credit card myths in Canada.

8 Common Credit Card Myths Busted

1. Closing Unused Credit Accounts Can Improve Your Credit Score

One of the most common credit score myths is that closing accounts you no longer use can hurt your credit score. The longer the credit account has been open, the more positive impact it has on your credit score.

Cancelling your credit card reduces your available credit, which may increase your credit utilization ratio and hurt your credit score.

You should aim for a credit utilization ratio (the amount of credit you have vs. the credit you use) to be 30% or below. If you go above this, credit card companies may think you’ll have difficulty repaying what you owe.

Let’s say you have three credit cards, each with a credit limit of $10,000. To have a good credit utilization ratio, you should spend $9,000 or less. If you cancel one of those cards, your ratio will decrease to $6,000.

Closing just one account can limit how much you can spend; if you go above that, your credit score (or FICO score in Canada) can take a hit.

2. You Shouldn’t Have Multiple Credit Cards

Many people think you should avoid having multiple credit cards, as applying for new cards can significantly lower your credit score. While it is true that credit card companies check your credit with a hard inquiry, which can lower your credit score by a few points, one single inquiry won’t have a large effect on your overall credit report.

However, if you apply for multiple credit cards in a short period, all those hard inquiries will likely damage your credit score. It may seem like you’re facing financial difficulties, and you may be less likely to get approved for new credit cards.

How many credit cards should I have in Canada?

There is no hard and fast rule as to how many credit cards you should have, but according to Equifax, it’s recommended that you have two or three credit accounts open at once. If you have more than three, keeping track of your monthly payments and due dates can be difficult.

Generally, you should wait at least three to six months before applying for another credit card. This gives you time to use your other credit cards responsibly and boost your credit report once again.

3. You Can’t Get a Credit Card If You Have Bad Credit

While generally, the minimum credit score for a credit card in Canada is 660 or above (a fair to good credit score), some cards are made for those with a low credit score or no credit history. These are called secured credit cards, which require a cash deposit (which is generally your credit limit) instead of a credit check.

Secured credit cards help you build credit fast, as each timely payment is reported to the credit bureaus. This is also a great credit card for newcomers to Canada who don’t have an existing credit history.

Some secured credit cards we recommend include:

If you’re wondering how to build your credit score in Canada and want to eventually apply for higher-tier credit cards, consider paying your rent and bills with Chexy, where you can opt into the Credit Builder and report your rent payments. Each timely rent payment is reported to Equifax, one of the major credit bureaus in Canada.

Using Chexy to pay your rent with debit is another great option that doesn’t require a credit card.

4. Credit Card Annual Fees Aren’t Worth It

Credit card fees can be quite high, but in most cases, they are worth it.

Take the American Express Platinum Card, for example. It has a $799 annual fee, but it comes with so many perks, like $200 travel and dining credits, unlimited access to airport lounges, travel coverage, and more.

You don’t have to use a credit card with fees as high as this, but if you take advantage of the benefits, they highly outweigh the annual fees.

Here are some of our favourite credit cards with annual fees that aren’t too high but give you amazing perks:

Scotia Momentum Visa Infinite Card – earn up to 4% cash back on all purchases

American Express Cobalt Card – earn up to 5x Membership Rewards points on all purchases

TD First Class Travel Visa Infinite Card† – earn TD Rewards Points on every purchase, plus many travel benefits

5. You Should Carry a Balance

Many people think carrying a balance on your credit card is a good way to improve your credit score in Canada. The common belief is that having a revolving balance each month will somehow benefit their credit score; however, this is not true.

The best way to use your credit card is to pay it off in full on the due date each month. This way, you won’t carry a balance and start paying interest. When you pay off your credit card balance, you maintain a lower credit utilization ratio, which highly benefits your credit score.

6. Checking Your Credit Score Hurts It

Does checking your credit score hurt it in Canada? Short answer: no.

There are two types of credit checks: a soft inquiry and a hard inquiry.

A soft credit inquiry is when you access your credit report through your bank or a credit bureau like Equifax, TransUnion, or Borrowell. This type of credit check will not affect your credit score.

A hard credit inquiry is when credit card companies or lenders look at your credit score to determine your eligibility for the credit product you’re applying for. This type of credit check will lower your credit score by a few points.

If you are responsible with your credit cards and don’t apply for too many at once, your credit score shouldn’t be affected much, if at all.

7. You Shouldn’t Have a High Credit Limit

Credit card companies use many different factors when deciding your credit limit. Generally, it’s not bad to have a high credit limit; instead, it shows lenders that you are a low-risk borrower and trustworthy enough to pay your bills on time.

With a high credit limit, be careful to stay within your credit utilization ratio of 30% of your limit. If you remain under that and pay off your credit card balance in full each month, a credit limit increase can improve your credit score.

The only time you might want to decline a credit limit increase is if you’re worried about the temptation to spend more.

8. Credit Cards Are for Emergencies Only

Growing up, most of us were told that credit cards should only be used in emergencies. While you shouldn’t be spending more than you can afford, credit cards are convenient for large expenses, such as rent and utilities, and everyday purchases.

Many credit cards offer rewards or cashback, and as long as you pay off the balance in full by the due date, a credit card is a great tool for building credit, tracking your spending, and earning rewards.

Read more about the benefits of credit cards here.

As long as you are responsible, you can use credit cards to your advantage.

If you pay rent every month, why not use your credit card and let your biggest monthly expense work for you? With Chexy, you can pay rent and bills with your credit card and earn rewards.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

Does Borrowell affect my credit score?

Checking your credit score with Borrowell will not affect your credit report, as it is a soft inquiry. It won’t even show up to lenders when they pull your score.

What is Canada’s average credit score?

According to FICO, the average credit score in Canada is around 762, which is considered good. It has increased slowly year over year, from 757 in 2018 to 762 in 2023.

What is a bad credit score in Canada?

In Canada, a credit score below 560 is considered bad. A 560 to 659 credit score is fair, and anything between 660 and 724 is considered good, according to Equifax.

† Terms and Conditions apply.

Disclaimer:

Financial institutions pay us for connecting them with customers. This could be through advertisements, or when someone applies or is approved for a product. However, not all products we list are tied to compensation for us. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

Frequently Asked Questions

Frequently Asked Questions

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?