Amex Aeroplan Reserve Card Spotlight: Travel Perks, Lounge Access, & More

Jan 5, 2026

Table of contents

Title

If you travel frequently, the American Express Aeroplan Reserve card is worth checking out. While it carries a high annual fee, the card comes with premium travel perks, comprehensive insurance coverage, and a strong points-earning structure that can more than offset the cost for frequent flyers.

In this Amex Aeroplan Reserve card review, we’ll break down everything you need to know about the card, including its benefits, lounge access, and insurance, as well as how it stacks up against other top-tier cards.

Amex Aeroplan Reserve Card: An Overview

$599 annual fee

$199 for each additional card

21.99% interest rate for purchases and cash advances

Earn 3x points on Air Canada purchases, 2x points on dining & food delivery, & 1.25x points on everything else

Welcome bonus of up to 85,000 points

Exceptional travel and Air Canada benefits

American Express Aeroplan Card Benefits

The Amex Aeroplan Reserve offers many benefits, from lounge access and insurance to a hefty welcome bonus:

Points Earning

With the Amex Aeroplan Reserve, you can earn:

3x Aeroplan points on Air Canada purchases

2x Aeroplan points on dining & food delivery

1.25x Aeroplan points on everything else (including Chexy payments)

Points don’t expire, and you can earn twice the points if you shop at the Aeroplan eStore.

Welcome Bonus

As of January 2026, you can earn up to 85,000 bonus Aeroplan points with the welcome offer:

Earn 60,000 Aeroplan points after spending $7,500 on your card within the first 3 months

Earn 25,000 Aeroplan points when you spend $2,500 in month 13

Reaching the minimum spend thresholds can be tough if you’re only using the card for everyday purchases. By putting larger expenses like rent, bills, or tuition on your card through Chexy, you can hit those thresholds much faster.

Travel Benefits

Besides the strong Aeroplan points-earning potential, the travel benefits are what justify this card’s hefty annual fee. With the Amex Aeroplan Reserve, you’ll enjoy:

A free first checked bag (for you and up to 8 companions)

Cardmembers can now get an extra night free for every 3 hotel nights redeemed with Aeroplan points.

An Annual Worldwide Companion Pass (when you spend $25,000 on your card within 12 months)

Priority airport check-in, boarding, baggage handling, & standby with Air Canada

Access to Air Canada Maple Leaf Lounges and Air Canada Cafes in North America

The Aeroplan Reserve includes a complimentary Priority Pass™ membership, which provides access to over 1,200 lounges worldwide (standard visit fees apply)

Reach Aeroplan Elite Status faster (earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $10,000 in eligible net purchases)

An extra 12 months to use eUpgrade credits

Priority perks at Toronto Pearson Airport

Savings with Avis car rentals

Comprehensive insurance

Starting in 2027, eligible cardmembers with Aeroplan Elite™ Status receive a 10% Head Start toward requalification based on Status Qualifying Credits earned the previous year.

Amex Aeroplan Reserve Lounge Access

Within North America, you and a guest can access select Maple Leaf Lounges and Air Canada Cafes with a same-day ticket on a departing Air Canada or Star Alliance flight.

Some notable Maple Leaf Lounges we think are worth checking out: Montreal (YUL), Calgary (YYC), St. John’s (YYT). See more of our thoughts in this blog.

The Aeroplan Reserve also comes with worldwide airport lounge access through a complimentary Priority Pass membership. Keep in mind, though, that while the membership fee is covered, individual lounge visits still come at the standard rate.

For frequent travellers who value the flexibility of lounge access, this can be a useful perk. But for those expecting unlimited free entry, it may feel a little underwhelming.

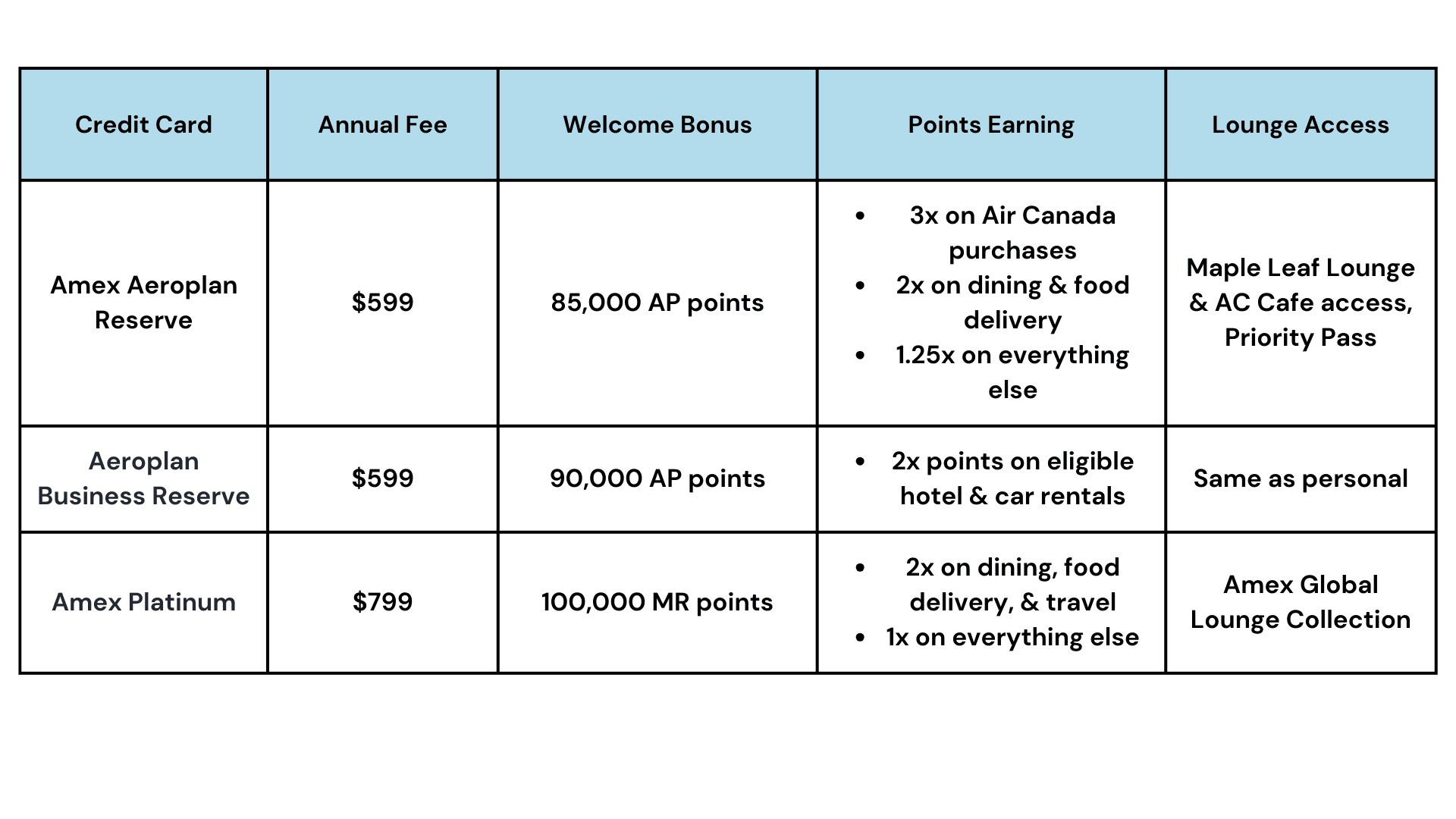

Amex Aeroplan Reserve vs Other Travel Credit Cards

Let’s see how the Aeroplan Reserve stacks up against two comparable American Express credit cards:

Amex Aeroplan Reserve vs Business Reserve

The Aeroplan Business Reserve has many of the same benefits as its personal counterpart. The only differences are:

Earn up to 90,000 points with the welcome bonus (65,000 points after spending $10,500 in the first 3 months + 25,000 points when you spend $3,500 in month 13)

Business benefits such as payment flexibility, free supplementary cards, and customer service

Employee card misuse protection

Amex Aeroplan Reserve vs Platinum

The main differences between the Amex Platinum and Reserve are:

Higher annual fee of $799

Earn up to 100,000 points with the welcome bonus (70,000 points when you spend $10,000 in the first 3 months + 30,000 points when you make a purchase between month 15 and 17)

Earn Amex Membership Reward points rather than Aeroplan points (however, they transfer to Aeroplan at a 1:1 ratio)

Earn 1x rather than 1.25x the points on most purchases

Get a $200 annual travel credit and a $200 annual dining credit

Access the Amex Global Lounge Collection

Better Hotel Status Benefits with Hilton Honors and Marriott Bonvoy

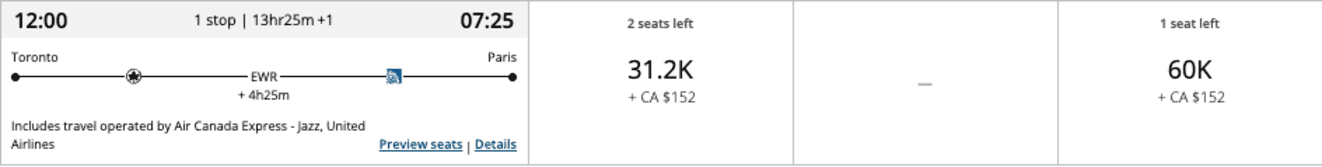

Where Can Your Aeroplan Points Take You?

Let’s look at a real example of how quickly Aeroplan points can add up with the Amex Aeroplan Reserve Card and Chexy:

You pay $3,000 every month in rent and bills with Chexy

With the 1.75% fee, that’s $3,052.50 per month, or $36,630 over one year

That’s 36,630 Aeroplan points, just from paying your biggest expenses.

Add in the current welcome bonus of 85,000 points, and you’re sitting at over 121,000 Aeroplan points in your first year without changing your spending habits.

What does that get you?

A round-trip business class flight to Europe

Multiple one-way economy class flights to Europe

Up to four round-trip economy flights within North America, depending on your route

Take a look at Air Canada’s flight reward chart to see exactly how far your points can take you.

How to Maximize the Amex Aeroplan Reserve with Chexy

The Amex Aeroplan Reserve is powerful on its own, but pairing it with Chexy unlocks even more value. Instead of limiting your points earning to everyday purchases, Chexy lets you put big expenses, like rent, tuition, taxes, and bills, on your credit card.

That means more Aeroplan points on the spending you’re already doing. Currently, you can also earn up to 5,000 bonus Aeroplan points* with our latest offer.

If you’re looking to fast-track your next trip, this is one of the easiest ways to supercharge your Aeroplan points balance.

Is It Worth It?

The Amex Aeroplan Reserve Card is undeniably premium, with a high annual fee to match.

If you’re a frequent traveller, you’ll get a lot of value out of this card: extensive travel insurance, priority airport perks, lounge access, and a strong points-earning structure and welcome offer for new cardholders.

On the other hand, if you don’t travel often or rarely fly with Air Canada, the benefits may not outweigh the cost. In that case, you may want to consider a lower-fee Aeroplan card or a more flexible rewards card.

Ultimately, if you value travel perks and want to maximize every dollar spent (especially on big expenses through Chexy), the Amex Aeroplan Reserve is more than worth it.

Get started with Chexy today to start earning American Express Aeroplan points on your biggest expenses.

Disclaimer:

† Terms and Conditions apply.

Financial institutions do not pay us for connecting them with customers. We may receive compensation in other ways, such as when someone applies for or is approved for a product. However, we do not receive payment for advertising, and not all products we list result in compensation for us. Advertisers are not responsible for the content on this site, including any editorial or review content that may appear. For complete and current information on any advertiser’s product, please visit their website.

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?