Top Credit Card Loyalty Programs in Canada: How to Maximize Your Rewards

Dec 31, 2025

Written by

Written by

Brianna Harrison (Credit Card & Travel Writer)

Brianna Harrison (Credit Card & Travel Writer)

Table of contents

Title

Title

Title

The world of credit card points and rewards is exciting, but it can also be difficult to understand as there are so many different rewards programs in Canada. But don’t worry – we’re here to help.

We’ll take a look at the best Canadian credit card rewards programs and dive into how they work, the top credit cards to use with them, and some tips and tricks on maximizing your rewards.

If you’re new to credit cards, check out these articles:

What Is a Credit Card Loyalty Program?

Most credit cards come with a rewards program that lets you earn points, miles, cash back, or other rewards when you make purchases with that credit card.

Cashback is generally earned on every purchase, with some spending categories, like groceries and gas, earning you more cash back. This cashback can be deposited into your account or used as a statement credit.

Points reward programs earn you a certain number of points per dollar spent. Depending on the rewards program, you can redeem them for statement credits, merchandise, gift cards, travel purchases, or charitable donations.

Learn more about cashback vs rewards credit cards.

Miles rewards credit cards are typically tied to one airline loyalty program. They earn points or miles for that specific airline and help you earn free flights, upgrades, and travel discounts.

Top Credit Card Canadian Rewards Programs

These are the best credit card rewards programs in Canada that earn you points or store rewards.

Amex Membership Rewards

One of the best loyalty programs in Canada, the American Express Membership Rewards program is tied to American Express credit cards. The reward points are valuable as you can earn and redeem them in different ways.

Many American Express cards earn you a different number of points based on certain spending categories. For example, the Amex Cobalt earns you 5x points on food and drinks, 3x points on streaming subscriptions, 2x points on transit, and 1x points on everything else.

To get the best value, transfer Amex points 1:1 to Aeroplan, and you'll be on your way to free flights. You can also redeem points for a statement credit, merchandise, gift cards, and more, however we DO NOT recommend this.

The best American Express credit cards to earn Membership Rewards are:

Scene+ Reward Points

Created by Scotiabank and Cineplex, the Scene+ rewards program allows members to earn points on everyday purchases with a Scotiabank debit or credit card and at Cineplex theatres.

Scene+ points can be earned at many grocery stores across Canada, including Sobeys, FreshCo, and Safeway. You can also earn them at various restaurants and pharmacies, on travel bookings, and at Cineplex.

You can redeem points on groceries for $10 off, at Cineplex for movie tickets, and at participating pharmacies, restaurants, and other Scene+ partners.

The fastest way to earn Scene+ points is using a Scene+ Scotiabank credit card. You can earn elevated points on certain spending categories and even redeem them for a statement credit.

Some of the top Scotiabank Scene+ credit cards include:

Tim Hortons Rewards

The Tims Rewards program earns you points on every purchase at Tim Hortons in Canada. After you meet a certain threshold, you can redeem those points for free coffee, donuts, food, and more. On the Tims Rewards app, you can get exclusive offers and even a free item on your birthday.

Tim Hortons Rewards have been around for a while, but the newer Tims Financial credit card lets you earn elevated points on each purchase.

You can earn:

15x points on Tim Hortons purchases

5x points for transit, gas, and groceries

0.5x points for everything else

Triangle Rewards

With the Triangle Rewards program, you can collect CT Money at Canadian Tire-branded stores, such as Canadian Tire, Mark’s, and Sport Chek. Membership is free, and you can apply directly on the Canadian Tire website or use one of the two Triangle credit cards.

When redeeming CT Money, $1 = $1 towards almost anything at Canadian Tire stores.

The Triangle credit cards are:

PC Optimum

The PC Optimum rewards program is one of the largest and best loyalty programs in Canada. You can earn and redeem points on everyday spending, like groceries, gas, and pharmacy purchases.

It is free to sign up for, but you’ll earn points much faster if you use one of the two PC Mastercards:

You can redeem PC Points on purchases at participating stores, such as Shoppers Drug Mart, Loblaws, and NoFrills. You must have 10,000 points, equivalent to $10 off.

Best Travel Rewards Programs in Canada

These are the most widely used and best credit card travel rewards programs in Canada.

Aeroplan

Aeroplan is Canada’s largest airline rewards program, linked to Air Canada and Star Alliance partners. Aeroplan points are worth about 2 cents per point, and you can redeem them on flights, vacation packages, lounge access, hotels, and more.

You can earn Aeroplan points by booking Air Canada and partner airline flights, shopping at the Aeroplan eStore, and linking your account with Starbucks, LCBO, Uber, and Journie Rewards.

How to maximize Aeroplan points:

The fastest way to earn Aeroplan points is by using an Aeroplan credit card. Some of the best airline rewards program credit cards that collect Aeroplan points include:

You can also use an American Express credit card to earn Amex Membership points and transfer them 1:1 to Aeroplan. If you go for the welcome bonus on an Amex card, you can really rack up the points.

Air Miles

Air Miles is one of Canada’s best travel rewards programs. You can earn miles by showing your membership card at participating retailers or using a BMO Air Miles credit card.

You can earn two types of Air Miles: Dream Miles and Cash Miles. Dream Miles are non-cash rewards, including flights, merchandise, and car rentals, and Cash Miles can be converted into cash to be used online or in-store at Air Miles partners.

These two credit cards earn you Air Miles on everyday purchases:

Marriott Bonvoy

One of the largest hotel chains in the world, the Marriott Bonvoy rewards program is worth signing up for if you stay at Marriott hotels often. This program allows you to earn and redeem points for free stays at Marriott Bonvoy brands, including The Ritz-Carlton, Sheraton, and Westin hotels.

It’s free to join, and all members can book hotels at discounted rates, get free wifi, and earn points toward free nights. The more often you stay at Marriott properties, you can level up to Marriott Bonvoy elite status and get additional benefits.

The best way to earn Marriott points is by using the Marriott Bonvoy American Express Card on everyday purchases.

WestJet Rewards

With the WestJet Rewards program, you earn WestJet Dollars on flights and vacation packages purchased through WestJet’s website. You can also earn WestJet Dollars on partner airlines, including Delta and Air France.

One WestJet Dollar is equivalent to one real dollar, and frequent flyers can earn up to 8% back in WestJet Dollars.

RBC has partnered with WestJet to offer these two WestJet RBC Mastercards, earning you an elevated amount of Dollars:

RBC Avion Rewards

Owned by RBC, Avion Rewards is Canada’s largest bank-owned loyalty program. You don’t need to have an RBC product or account to sign up, but using one of their credit cards gets you access to more perks and higher earning tiers.

Avion Rewards members get cash back at over 2,400 retailers and earn points on purchases. Avion points can be redeemed for flights, a statement credit, converted to partner airline programs, and more.

These are the top RBC Avion credit cards:

How to Maximize Your Credit Card Points

If you want to use credit cards to your advantage and be on your way to earning free flights or other perks, you’ll need to learn how to maximize your credit card points. Here are a few tips on how to do so:

Take Advantage of Welcome Bonuses

Many credit cards offer a large welcome bonus when you sign up and get approved. Welcome bonuses can include a high percentage of cashback, an elevated number of points, or other perks like a free travel credit or the first-year annual fee waived.

When choosing a credit card with a large welcome bonus, pay attention to the terms of how you can earn that bonus. To qualify, you’ll often need to make a purchase of over a certain amount within a few months of opening your account.

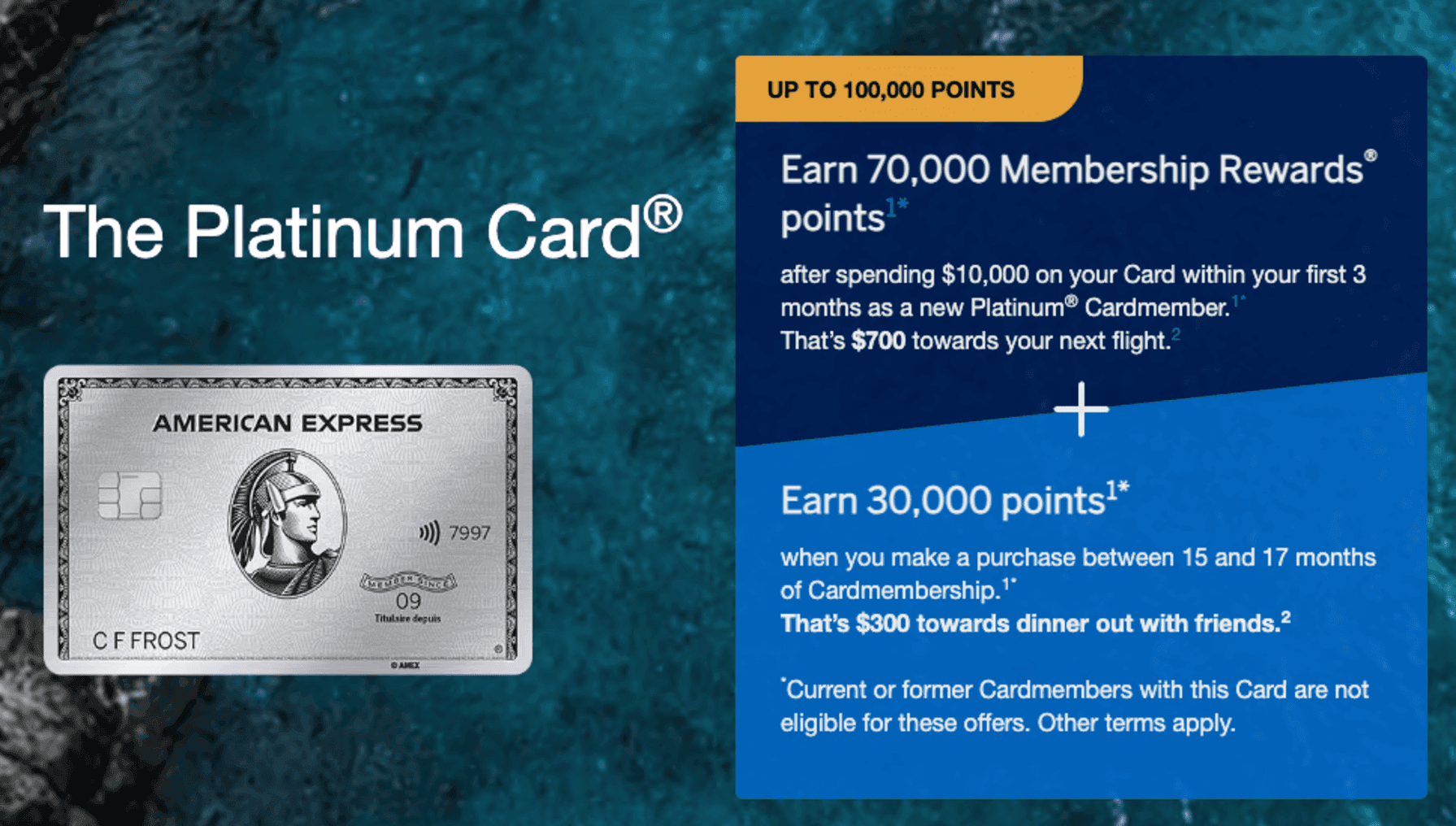

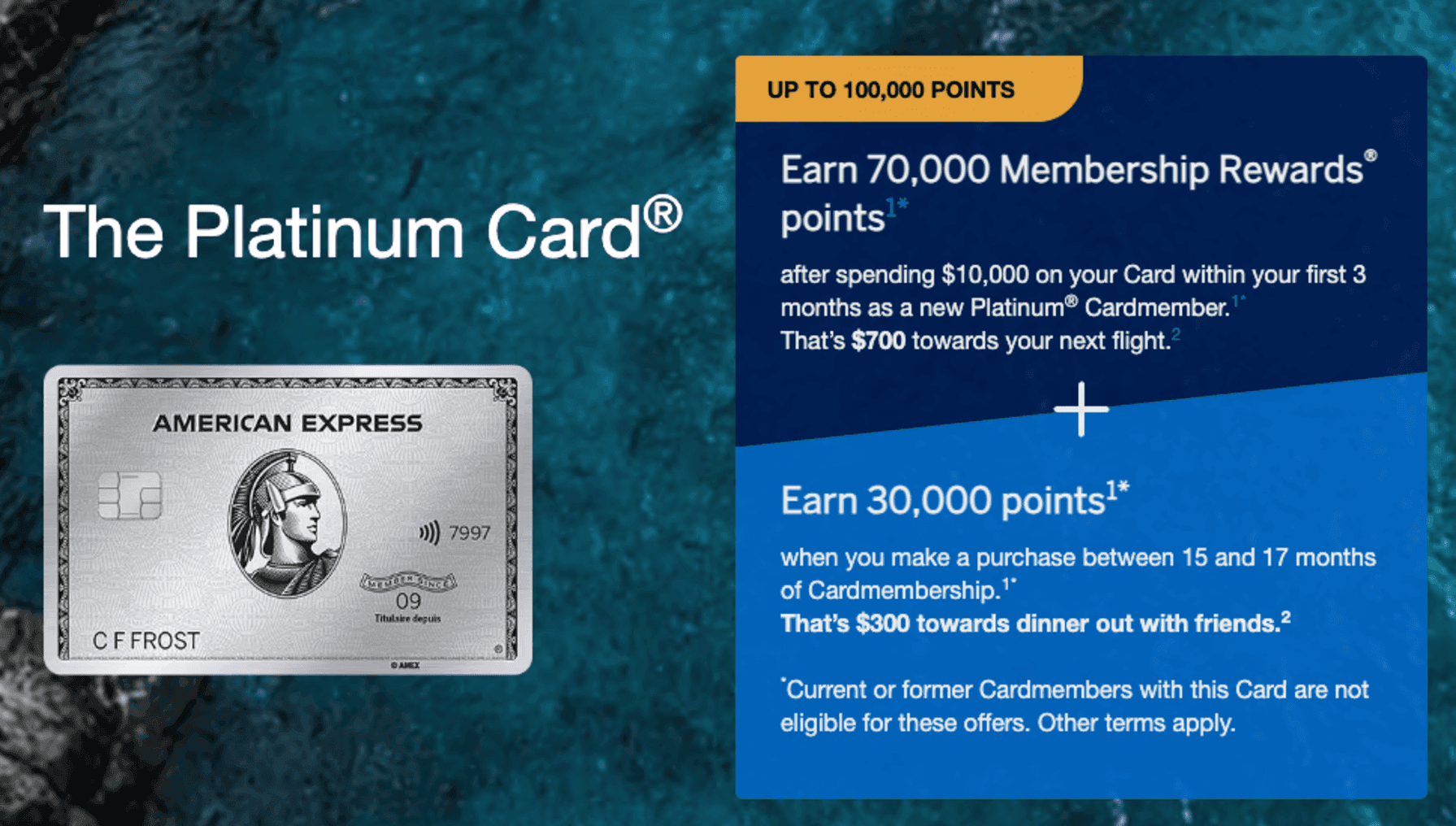

The Amex Platinum Card welcome bonus

Currently, you can earn up to 100,000 MR points when you sign up for the Amex Platinum:

70,000 points after spending $10,000 in 3 months

30,000 points after making any purchase between the 15th and 17th month

Choose a Card With Flexible Reward Options

Some credit cards have quite limited rewards programs. If you’re not loyal to a specific airline or brand, choose a credit card with transferable points or one with flexible rewards options.

For example, most American Express credit cards allow you to transfer points 1:1 to major airlines, such as Air Canada and British Airways.

Check the Big Spending Categories

Some credit cards offer 5 or 6 times the number of points on certain spending categories, such as travel, gas, and grocery purchases. If you spend a lot of money in these categories, you’ll get the most out of your credit card.

For example, the American Express Cobalt Credit Card earns you up to 5x the points on everyday spending. You can earn:

5x points on food and drinks

3x points on streaming subscriptions

2x points on transit and rideshare

1x points on everything else

If you spend a lot on eating out and streaming services, you can easily rack up the Amex Membership Rewards points, which have flexible redemption rates.

Get More Than One Credit Card

Depending on what you spend the most money on, getting more than one credit card can be a good idea. Let’s say you spend a lot on groceries and restaurants, but you also book many trips with one specific airline.

To maximize the rewards potential for groceries and recurring bills, you can use a cashback credit card that earns you 4% back, like the Scotia Momentum Visa Infinite Card. You could also get an airline-branded credit card to earn the most points when booking flights and hotels.

Pay Your Bills With Your Credit Card

You'll earn points much faster by using your credit card to pay for large expenses and bills, such as your rent or an airline ticket.

By using Chexy and your credit card to pay rent and bills, you’ll earn points, miles, or cashback, build your credit score, and access other helpful features such as rent splitting.

What Is the Best Credit Card for Rewards in Canada?

With so many rewards credit cards, it can be overwhelming to choose just one. Consider these factors to narrow down your options:

What categories do you spend the most money in?

Look at your monthly spending and note down your biggest spending categories. If you spend a lot on groceries, you might want a credit card that earns you a lot of cashback in that category. On the other hand, if you spend a lot of money on travel or transportation, consider getting a travel rewards or airline credit card.

Are you loyal to one rewards program, airline, or brand?

If you shop at specific stores or only fly on a certain airline, consider getting a credit card that will earn you the most points for those purchases. For example, if you shop at stores like NoFrills and Shoppers Drug Mart often, the PC Mastercard will help you earn points faster.

Which type of rewards do you want to earn?

Consider a cashback card if you prefer a simple rewards card with a flat earning rate. An airline or travel credit card could be a better option if you want to earn points towards travel. Be sure to compare all credit cards with rewards programs like Aeroplan vs WestJet Rewards.

Compare all the features and benefits

Compare the interest rates, annual fees, welcome bonuses, and all other perks, such as travel and purchase insurance. Some credit cards offer low annual fees and interest rates but generally offer fewer perks than higher-tier credit cards.

Are you using a rewards credit card but not earning points fast enough? With Chexy, you can pay rent and bills with your credit card to earn rewards faster. If you’re looking to build your credit score so you can be approved for a higher-tier credit card, Chexy can help with that, too.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

† Terms and Conditions apply.

The world of credit card points and rewards is exciting, but it can also be difficult to understand as there are so many different rewards programs in Canada. But don’t worry – we’re here to help.

We’ll take a look at the best Canadian credit card rewards programs and dive into how they work, the top credit cards to use with them, and some tips and tricks on maximizing your rewards.

If you’re new to credit cards, check out these articles:

What Is a Credit Card Loyalty Program?

Most credit cards come with a rewards program that lets you earn points, miles, cash back, or other rewards when you make purchases with that credit card.

Cashback is generally earned on every purchase, with some spending categories, like groceries and gas, earning you more cash back. This cashback can be deposited into your account or used as a statement credit.

Points reward programs earn you a certain number of points per dollar spent. Depending on the rewards program, you can redeem them for statement credits, merchandise, gift cards, travel purchases, or charitable donations.

Learn more about cashback vs rewards credit cards.

Miles rewards credit cards are typically tied to one airline loyalty program. They earn points or miles for that specific airline and help you earn free flights, upgrades, and travel discounts.

Top Credit Card Canadian Rewards Programs

These are the best credit card rewards programs in Canada that earn you points or store rewards.

Amex Membership Rewards

One of the best loyalty programs in Canada, the American Express Membership Rewards program is tied to American Express credit cards. The reward points are valuable as you can earn and redeem them in different ways.

Many American Express cards earn you a different number of points based on certain spending categories. For example, the Amex Cobalt earns you 5x points on food and drinks, 3x points on streaming subscriptions, 2x points on transit, and 1x points on everything else.

To get the best value, transfer Amex points 1:1 to Aeroplan, and you'll be on your way to free flights. You can also redeem points for a statement credit, merchandise, gift cards, and more, however we DO NOT recommend this.

The best American Express credit cards to earn Membership Rewards are:

Scene+ Reward Points

Created by Scotiabank and Cineplex, the Scene+ rewards program allows members to earn points on everyday purchases with a Scotiabank debit or credit card and at Cineplex theatres.

Scene+ points can be earned at many grocery stores across Canada, including Sobeys, FreshCo, and Safeway. You can also earn them at various restaurants and pharmacies, on travel bookings, and at Cineplex.

You can redeem points on groceries for $10 off, at Cineplex for movie tickets, and at participating pharmacies, restaurants, and other Scene+ partners.

The fastest way to earn Scene+ points is using a Scene+ Scotiabank credit card. You can earn elevated points on certain spending categories and even redeem them for a statement credit.

Some of the top Scotiabank Scene+ credit cards include:

Tim Hortons Rewards

The Tims Rewards program earns you points on every purchase at Tim Hortons in Canada. After you meet a certain threshold, you can redeem those points for free coffee, donuts, food, and more. On the Tims Rewards app, you can get exclusive offers and even a free item on your birthday.

Tim Hortons Rewards have been around for a while, but the newer Tims Financial credit card lets you earn elevated points on each purchase.

You can earn:

15x points on Tim Hortons purchases

5x points for transit, gas, and groceries

0.5x points for everything else

Triangle Rewards

With the Triangle Rewards program, you can collect CT Money at Canadian Tire-branded stores, such as Canadian Tire, Mark’s, and Sport Chek. Membership is free, and you can apply directly on the Canadian Tire website or use one of the two Triangle credit cards.

When redeeming CT Money, $1 = $1 towards almost anything at Canadian Tire stores.

The Triangle credit cards are:

PC Optimum

The PC Optimum rewards program is one of the largest and best loyalty programs in Canada. You can earn and redeem points on everyday spending, like groceries, gas, and pharmacy purchases.

It is free to sign up for, but you’ll earn points much faster if you use one of the two PC Mastercards:

You can redeem PC Points on purchases at participating stores, such as Shoppers Drug Mart, Loblaws, and NoFrills. You must have 10,000 points, equivalent to $10 off.

Best Travel Rewards Programs in Canada

These are the most widely used and best credit card travel rewards programs in Canada.

Aeroplan

Aeroplan is Canada’s largest airline rewards program, linked to Air Canada and Star Alliance partners. Aeroplan points are worth about 2 cents per point, and you can redeem them on flights, vacation packages, lounge access, hotels, and more.

You can earn Aeroplan points by booking Air Canada and partner airline flights, shopping at the Aeroplan eStore, and linking your account with Starbucks, LCBO, Uber, and Journie Rewards.

How to maximize Aeroplan points:

The fastest way to earn Aeroplan points is by using an Aeroplan credit card. Some of the best airline rewards program credit cards that collect Aeroplan points include:

You can also use an American Express credit card to earn Amex Membership points and transfer them 1:1 to Aeroplan. If you go for the welcome bonus on an Amex card, you can really rack up the points.

Air Miles

Air Miles is one of Canada’s best travel rewards programs. You can earn miles by showing your membership card at participating retailers or using a BMO Air Miles credit card.

You can earn two types of Air Miles: Dream Miles and Cash Miles. Dream Miles are non-cash rewards, including flights, merchandise, and car rentals, and Cash Miles can be converted into cash to be used online or in-store at Air Miles partners.

These two credit cards earn you Air Miles on everyday purchases:

Marriott Bonvoy

One of the largest hotel chains in the world, the Marriott Bonvoy rewards program is worth signing up for if you stay at Marriott hotels often. This program allows you to earn and redeem points for free stays at Marriott Bonvoy brands, including The Ritz-Carlton, Sheraton, and Westin hotels.

It’s free to join, and all members can book hotels at discounted rates, get free wifi, and earn points toward free nights. The more often you stay at Marriott properties, you can level up to Marriott Bonvoy elite status and get additional benefits.

The best way to earn Marriott points is by using the Marriott Bonvoy American Express Card on everyday purchases.

WestJet Rewards

With the WestJet Rewards program, you earn WestJet Dollars on flights and vacation packages purchased through WestJet’s website. You can also earn WestJet Dollars on partner airlines, including Delta and Air France.

One WestJet Dollar is equivalent to one real dollar, and frequent flyers can earn up to 8% back in WestJet Dollars.

RBC has partnered with WestJet to offer these two WestJet RBC Mastercards, earning you an elevated amount of Dollars:

RBC Avion Rewards

Owned by RBC, Avion Rewards is Canada’s largest bank-owned loyalty program. You don’t need to have an RBC product or account to sign up, but using one of their credit cards gets you access to more perks and higher earning tiers.

Avion Rewards members get cash back at over 2,400 retailers and earn points on purchases. Avion points can be redeemed for flights, a statement credit, converted to partner airline programs, and more.

These are the top RBC Avion credit cards:

How to Maximize Your Credit Card Points

If you want to use credit cards to your advantage and be on your way to earning free flights or other perks, you’ll need to learn how to maximize your credit card points. Here are a few tips on how to do so:

Take Advantage of Welcome Bonuses

Many credit cards offer a large welcome bonus when you sign up and get approved. Welcome bonuses can include a high percentage of cashback, an elevated number of points, or other perks like a free travel credit or the first-year annual fee waived.

When choosing a credit card with a large welcome bonus, pay attention to the terms of how you can earn that bonus. To qualify, you’ll often need to make a purchase of over a certain amount within a few months of opening your account.

The Amex Platinum Card welcome bonus

Currently, you can earn up to 100,000 MR points when you sign up for the Amex Platinum:

70,000 points after spending $10,000 in 3 months

30,000 points after making any purchase between the 15th and 17th month

Choose a Card With Flexible Reward Options

Some credit cards have quite limited rewards programs. If you’re not loyal to a specific airline or brand, choose a credit card with transferable points or one with flexible rewards options.

For example, most American Express credit cards allow you to transfer points 1:1 to major airlines, such as Air Canada and British Airways.

Check the Big Spending Categories

Some credit cards offer 5 or 6 times the number of points on certain spending categories, such as travel, gas, and grocery purchases. If you spend a lot of money in these categories, you’ll get the most out of your credit card.

For example, the American Express Cobalt Credit Card earns you up to 5x the points on everyday spending. You can earn:

5x points on food and drinks

3x points on streaming subscriptions

2x points on transit and rideshare

1x points on everything else

If you spend a lot on eating out and streaming services, you can easily rack up the Amex Membership Rewards points, which have flexible redemption rates.

Get More Than One Credit Card

Depending on what you spend the most money on, getting more than one credit card can be a good idea. Let’s say you spend a lot on groceries and restaurants, but you also book many trips with one specific airline.

To maximize the rewards potential for groceries and recurring bills, you can use a cashback credit card that earns you 4% back, like the Scotia Momentum Visa Infinite Card. You could also get an airline-branded credit card to earn the most points when booking flights and hotels.

Pay Your Bills With Your Credit Card

You'll earn points much faster by using your credit card to pay for large expenses and bills, such as your rent or an airline ticket.

By using Chexy and your credit card to pay rent and bills, you’ll earn points, miles, or cashback, build your credit score, and access other helpful features such as rent splitting.

What Is the Best Credit Card for Rewards in Canada?

With so many rewards credit cards, it can be overwhelming to choose just one. Consider these factors to narrow down your options:

What categories do you spend the most money in?

Look at your monthly spending and note down your biggest spending categories. If you spend a lot on groceries, you might want a credit card that earns you a lot of cashback in that category. On the other hand, if you spend a lot of money on travel or transportation, consider getting a travel rewards or airline credit card.

Are you loyal to one rewards program, airline, or brand?

If you shop at specific stores or only fly on a certain airline, consider getting a credit card that will earn you the most points for those purchases. For example, if you shop at stores like NoFrills and Shoppers Drug Mart often, the PC Mastercard will help you earn points faster.

Which type of rewards do you want to earn?

Consider a cashback card if you prefer a simple rewards card with a flat earning rate. An airline or travel credit card could be a better option if you want to earn points towards travel. Be sure to compare all credit cards with rewards programs like Aeroplan vs WestJet Rewards.

Compare all the features and benefits

Compare the interest rates, annual fees, welcome bonuses, and all other perks, such as travel and purchase insurance. Some credit cards offer low annual fees and interest rates but generally offer fewer perks than higher-tier credit cards.

Are you using a rewards credit card but not earning points fast enough? With Chexy, you can pay rent and bills with your credit card to earn rewards faster. If you’re looking to build your credit score so you can be approved for a higher-tier credit card, Chexy can help with that, too.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

† Terms and Conditions apply.

Disclaimer:

Financial institutions do not pay us for connecting them with customers. We may receive compensation in other ways, such as when someone applies for or is approved for a product. However, we do not receive payment for advertising, and not all products we list result in compensation for us. Advertisers are not responsible for the content on this site, including any editorial or review content that may appear. For complete and current information on any advertiser’s product, please visit their website.

Frequently Asked Questions

Frequently Asked Questions

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?