Navigating the Canadian Mortgage Landscape: How to Get a Mortgage Pre-Approval

Sep 22, 2024

Written by

Written by

Diamond Noul (Chexy Staff)

Diamond Noul (Chexy Staff)

Table of contents

Title

Title

Title

Starting your journey to homeownership in Canada can be a time-consuming and stressful experience, especially given the current state of the housing market. However, planning ahead can significantly impact how smoothly your home-buying process goes. And that begins with the single most important step – mortgage pre-approval.

Let’s dive into everything you need to know about mortgage pre-approvals in Canada, and how Homewise and Chexy are streamlining the process, allowing you to browse and compare the best mortgage rates from various banks and lenders. Providing you with the most accurate, easy, and free pre-approval process that now is just a few clicks away. Let's get into it!

What Are Mortgages?

A mortgage is a loan specifically used for a home. It involves an agreement between the borrower and a lender, typically a financial institution.

Pre-Qualification vs. Pre-Approval: What is the difference

Before we dive into pre-approval, it's essential to differentiate it from pre-qualification. While pre-qualification provides an estimate of how much you can borrow, pre-approval is a more in-depth process that involves a deep dive into your financial background to give you the most accurate result.

Benefits of Mortgage Pre-Approval

Securing a pre-approval before house hunting offers several advantages. It gives you a clear understanding of your budget, makes you a more appealing buyer, and expedites the final mortgage approval process.

Reasons to Secure a Pre-Approved Mortgage

Pre-approvals solidify the home buying process, providing clarity on your borrowing capacity, loan repayment, and mortgage rate. Unlike pre-qualification, a pre-approval signifies a lender's commitment to providing you with financing.

Here's why it's essential:

Know Your Borrowing Capacity: Efficiently shop for homes by understanding how much you can borrow, preventing the heartache of falling in love with a property that’s out of your reach.

Plan Monthly Payments with Down Payment Calculation: Start turning your homeownership dreams into reality by determining your loan size, setting a budget, and scheduling your mortgage payments, even before finding your ideal home.

Protect Your Interest Rate: Shield yourself from market fluctuations by securing your rate for 120 days. Pre-approvals allow you to shop confidently without the stress of interest rate rises.

Stand Out Among Buyers: Being a pre-approved buyer positions you as serious and financially reliable. Sellers and brokers appreciate the transparency, knowing your offer is solid and negotiation-ready.

Streamline Your Home Search: Time is money, and a pre-approval narrows down your search, helping you target properties within your budget efficiently.

Where to Obtain Mortgage Pre-Approval in Canada

Getting pre-approved for a mortgage in Canada is a straightforward process and can be done through various institutions, including:

Canada’s Big 6 Banks: TD Bank, RBC, BMO, Scotiabank, National Bank, and CIBC.

Credit Unions: Such as Vancity, Meridian Credit Union, and Access Credit Union.

B Lenders: Including First National Financial, MCAP, and MERIX Financial.

You have the option to deal directly with a lender or work with a mortgage broker, who will compare offers from different lenders and pre-approve you for the one that aligns with your financial situation – This is where HomeWise comes in!

The Application Process With Homewise and Chexy

Applying for a mortgage with Homewise streamlines the pre-approval process for you. In less than 5 minutes, you can start your application by answering preliminary questions about your homeownership goals, budget, and property preferences.

Here are the steps:

Preliminary Questions

Is this your first home?

Where are you looking to buy, and what's your budget estimate?

What type of property are you seeking, and do you plan to live in it or rent it out?

Pre-Approval Steps

Provide your date of birth.

Share your marital and citizenship status.

Indicate your current residence.

Include details about your mortgage payment and move-in date (if applicable).

Provide information about your employment status and income.

Specify if you're applying alone, with a co-signer or co-applicant.

Enter details about your assets and debts for a more accurate pre-approval result.

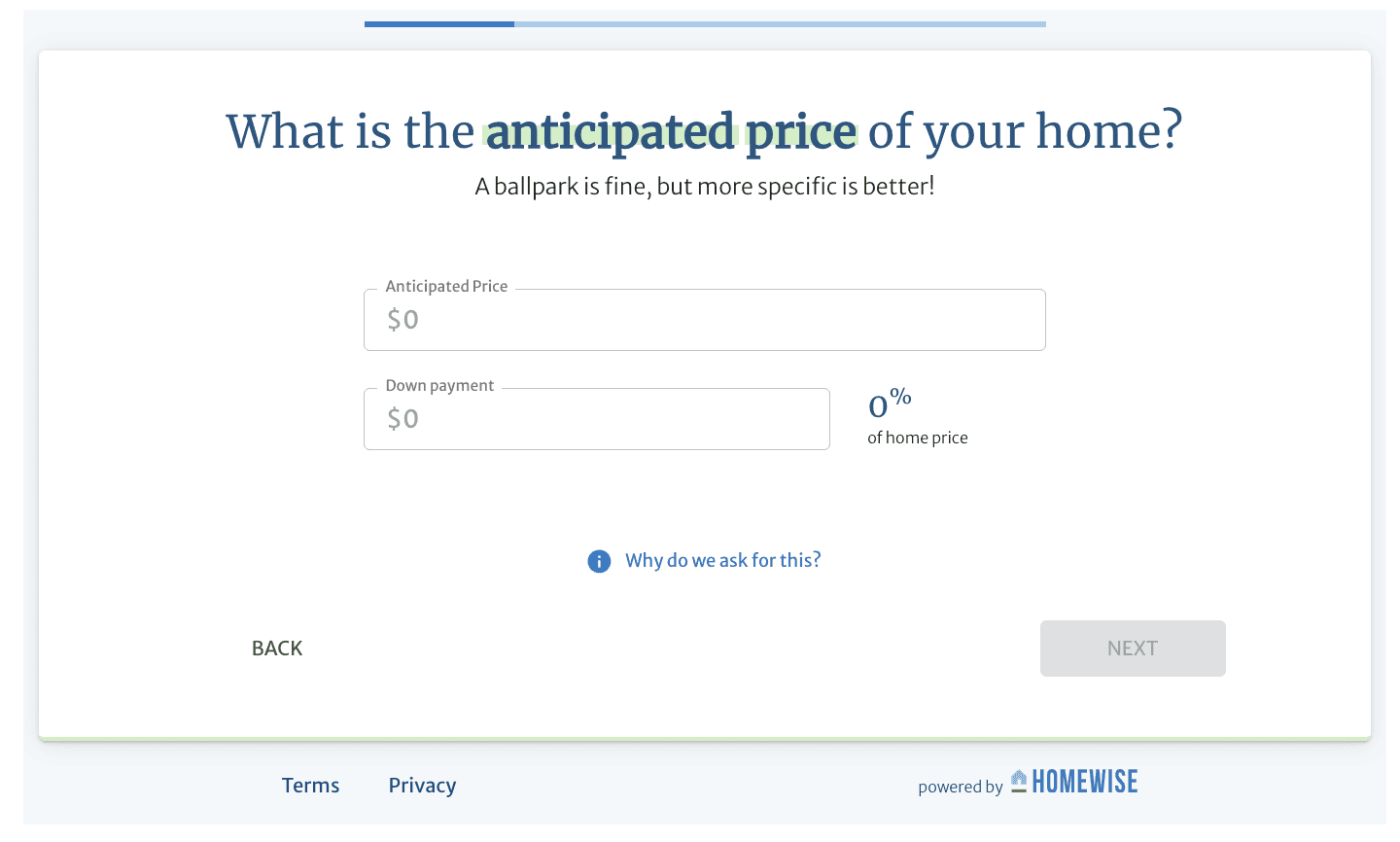

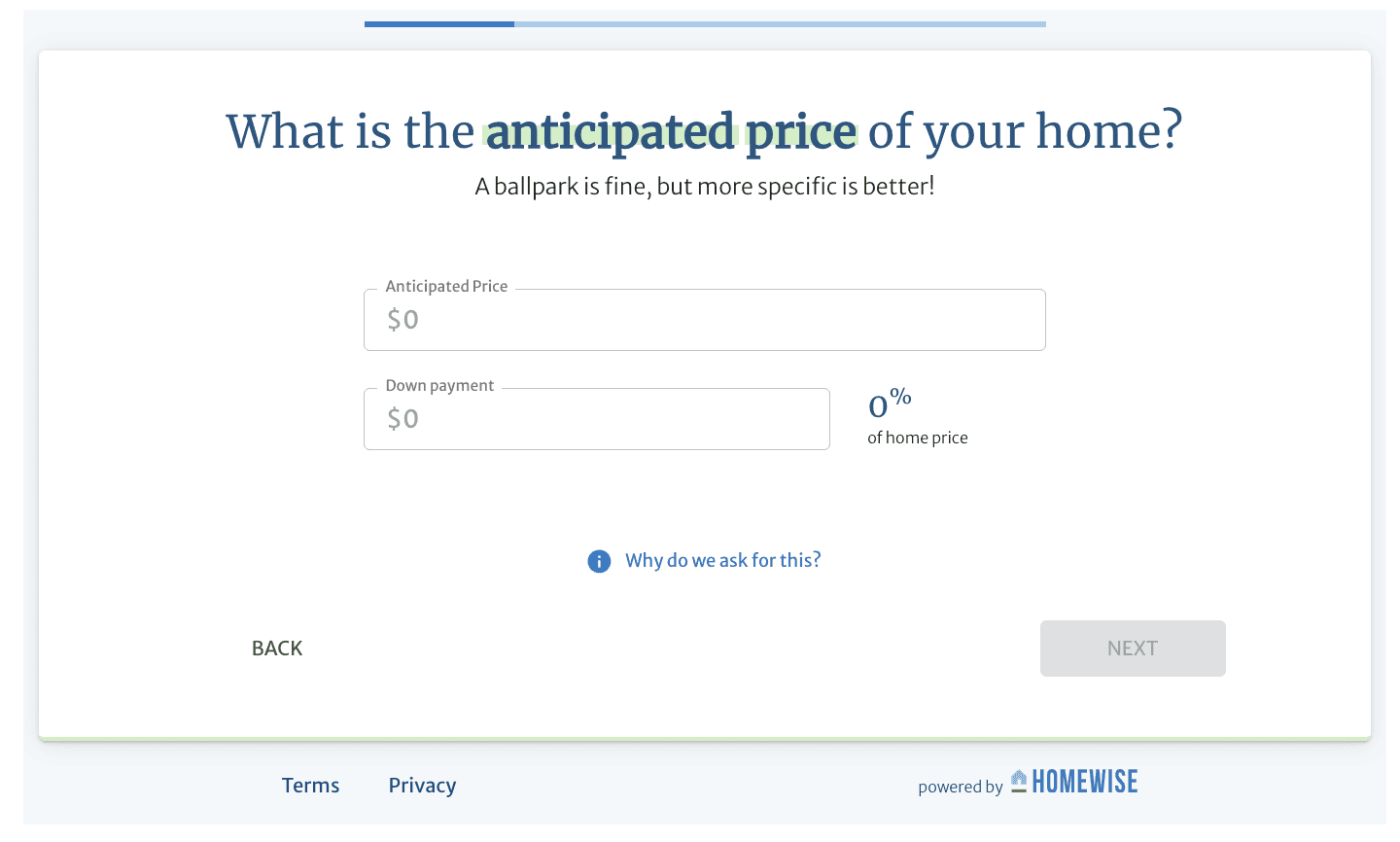

Here’s what some of the steps look like:

Follow-up and Document Submission

Expect a follow-up call from a Homewise advisor to discuss your preferences further and get the process moving. To finalize your application, you'll need to submit key documents, including income confirmation (T4, job letter, or pay stub), credit check authorization, and personal identification.

Now, lets dive into some things you should know about mortgages if you aren’t already aware.

Common Concerns with Pre-Approvals

With this process requiring sensitive information like your credit score and a look into your finances, there are bound to be some concerns. One common concern is the impact on your credit score. While a credit check is part of the pre-approval process, the impact on your credit score is very minimal and does not stay on your credit history for long.

Another concern is the validity period of pre-approvals. Pre-approvals typically remain valid for up to 120 days, giving you enough time to find the right property.

Types of Mortgages

Understanding the types of mortgages available to you is a crucial step that can not only help gauge what the next few years of payments will look like but also help in the decision-making process. There are two main types: Fixed-rate mortgages and Variable-rate mortgages.

Fixed-rate mortgages offer stability, while variable-rate mortgages can lead to potential savings. Each type has its advantages and disadvantages, depending on your financial goals and risk tolerance.

Fixed-Rate Mortgages Offer Stability

Advantages:

Stable Monthly Payments: One of the key advantages of a fixed-rate mortgage is the predictability of monthly payments. Your interest rate remains constant for the entire term of the loan, providing financial stability and making budgeting easier.

Long-Term Planning: Fixed-rate mortgages are ideal for individuals who prioritize long-term financial planning. Knowing that your interest rate won't change allows you to budget confidently for the entire duration of the mortgage.

Protection from Rate Fluctuations: In a rising interest rate environment, fixed-rate mortgages shield you from increased payments, offering peace of mind and financial security.

Disadvantages:

Higher Initial Rates: The trade-off for stability is often a slightly higher initial interest rate compared to variable-rate mortgages. However, this premium assures future rate hikes.

Less Flexibility in Rate Drops: If market interest rates decrease, fixed-rate mortgage holders might miss out on potential savings since their rate remains unchanged.

Variable-Rate Mortgages Offer Potential Savings and Flexibility

Advantages:

Potential Interest Savings: Variable-rate mortgages are tied to a benchmark interest rate, typically the prime rate. In a falling interest rate environment, borrowers can benefit from lower interest costs and potentially save money over the life of the mortgage.

Lower Initial Rates: Variable-rate mortgages often start with lower initial interest rates compared to fixed-rate mortgages, making them attractive to those seeking lower upfront costs.

Flexibility in Rate Drops: If market interest rates decrease, variable-rate mortgage holders can take advantage of lower rates, resulting in decreased monthly payments and potential interest savings.

Disadvantages:

Rate Fluctuations: The primary drawback of variable-rate mortgages is the inherent uncertainty in interest rate fluctuations. Monthly payments can increase if interest rates rise, leading to financial unpredictability.

Budgeting Challenges: For individuals who prefer a stable and predictable budget, the potential for fluctuating interest rates may pose challenges in financial planning.

Choosing Between Closed and Open Mortgages

In addition to the decision between fixed and variable rates, another crucial aspect of your mortgage journey involves selecting between closed and open mortgages.

Closed-term mortgages

Closed-term mortgages are a common choice among homeowners seeking lower interest rates. However, this decision comes with a trade-off – should you wish to renegotiate or pay off the balance before the term concludes, you may have to pay a penalty. Despite this, closed-rate mortgages often come with prepayment options, allowing you to make extra payments without penalties.

Open-rate mortgages

These offer flexibility, making them a great option if you plan to repay your mortgage soon. With open mortgages, you can repay either part or the entire mortgage without worrying about fees. Additionally, converting your mortgage to another term without penalties is a viable option. This flexibility, though advantageous, comes with a cost in the form of higher interest rates.

Amortization Period and Term

Given the nature of mortgages, repayment occurs over an extended period, known as the amortization period. The typical amortization period is around 25 years for most new homeowners, however, there is flexibility to opt for a 30-year period in certain situations. Extending the amortization period reduces monthly payments but results in a higher total interest payment over the mortgage's lifespan.

Your mortgage term defines the duration of your contract with a lender. Although a five-year term is a popular choice, terms can range from one to 10 years.

Payment Frequency Options

When setting up your mortgage, payment frequency options play a pivotal role in determining both the amount and frequency of payments. Your options include:

Monthly: Payments occur once a month.

Bi-weekly: Payments are made twice a month.

Accelerated Bi-weekly: Your monthly payment is divided by two and paid every other week, allowing you to make extra payments and pay off your mortgage faster.

Weekly: Similar to bi-weekly, with payments occurring every week.

Accelerated Weekly: Your monthly payment is divided by four and paid every week.

Carefully considering these payment frequency options allows you to tailor your mortgage structure to your goals and preferences.

Which Mortgage Is Right for You?

For Stability Seekers: If you value financial predictability and plan to stay in your home for an extended period, a fixed-rate mortgage is likely the better choice. This is particularly beneficial in environments with low interest rates.

For Risk-Tolerant Individuals: If you are comfortable with some level of financial uncertainty and believe that interest rates will remain stable or decrease, a variable-rate mortgage might offer potential cost savings, especially in the short to medium term.

Selecting between a fixed-rate and a variable-rate mortgage depends on your risk tolerance, financial goals, and the current economic environment. It's advisable to consult with financial experts or mortgage advisors to assess your specific situation and make an informed decision that aligns with your homeownership objectives. Remember, the right mortgage type contributes significantly to your overall financial well-being and the success of your homeownership journey.

Concluding Thoughts

The journey to homeownership is a stressful one, but securing a mortgage pre-approval is the single most important step that will set the tone for your entire home-buying experience. With Homewise and Chexy by your side, this process becomes easy, quick, and, most importantly–stress-free.

It’s also worth noting that if you’re currently a renter and want to improve your credit score for a better interest rate, consider renting through Chexy. You’ll not only earn rewards that you would have otherwise missed out on, but with the help of the Chexy Credit Builder, you can have your rent payments reported to Equifax, helping you build your credit history and making an impact on your credit score.

House hunting starts with knowing what you can afford, and a pre-approval with HomeWise does just that! It’s time to take your first step in your home-buying journey, so start with HomeWise.

† Terms and Conditions apply.

Starting your journey to homeownership in Canada can be a time-consuming and stressful experience, especially given the current state of the housing market. However, planning ahead can significantly impact how smoothly your home-buying process goes. And that begins with the single most important step – mortgage pre-approval.

Let’s dive into everything you need to know about mortgage pre-approvals in Canada, and how Homewise and Chexy are streamlining the process, allowing you to browse and compare the best mortgage rates from various banks and lenders. Providing you with the most accurate, easy, and free pre-approval process that now is just a few clicks away. Let's get into it!

What Are Mortgages?

A mortgage is a loan specifically used for a home. It involves an agreement between the borrower and a lender, typically a financial institution.

Pre-Qualification vs. Pre-Approval: What is the difference

Before we dive into pre-approval, it's essential to differentiate it from pre-qualification. While pre-qualification provides an estimate of how much you can borrow, pre-approval is a more in-depth process that involves a deep dive into your financial background to give you the most accurate result.

Benefits of Mortgage Pre-Approval

Securing a pre-approval before house hunting offers several advantages. It gives you a clear understanding of your budget, makes you a more appealing buyer, and expedites the final mortgage approval process.

Reasons to Secure a Pre-Approved Mortgage

Pre-approvals solidify the home buying process, providing clarity on your borrowing capacity, loan repayment, and mortgage rate. Unlike pre-qualification, a pre-approval signifies a lender's commitment to providing you with financing.

Here's why it's essential:

Know Your Borrowing Capacity: Efficiently shop for homes by understanding how much you can borrow, preventing the heartache of falling in love with a property that’s out of your reach.

Plan Monthly Payments with Down Payment Calculation: Start turning your homeownership dreams into reality by determining your loan size, setting a budget, and scheduling your mortgage payments, even before finding your ideal home.

Protect Your Interest Rate: Shield yourself from market fluctuations by securing your rate for 120 days. Pre-approvals allow you to shop confidently without the stress of interest rate rises.

Stand Out Among Buyers: Being a pre-approved buyer positions you as serious and financially reliable. Sellers and brokers appreciate the transparency, knowing your offer is solid and negotiation-ready.

Streamline Your Home Search: Time is money, and a pre-approval narrows down your search, helping you target properties within your budget efficiently.

Where to Obtain Mortgage Pre-Approval in Canada

Getting pre-approved for a mortgage in Canada is a straightforward process and can be done through various institutions, including:

Canada’s Big 6 Banks: TD Bank, RBC, BMO, Scotiabank, National Bank, and CIBC.

Credit Unions: Such as Vancity, Meridian Credit Union, and Access Credit Union.

B Lenders: Including First National Financial, MCAP, and MERIX Financial.

You have the option to deal directly with a lender or work with a mortgage broker, who will compare offers from different lenders and pre-approve you for the one that aligns with your financial situation – This is where HomeWise comes in!

The Application Process With Homewise and Chexy

Applying for a mortgage with Homewise streamlines the pre-approval process for you. In less than 5 minutes, you can start your application by answering preliminary questions about your homeownership goals, budget, and property preferences.

Here are the steps:

Preliminary Questions

Is this your first home?

Where are you looking to buy, and what's your budget estimate?

What type of property are you seeking, and do you plan to live in it or rent it out?

Pre-Approval Steps

Provide your date of birth.

Share your marital and citizenship status.

Indicate your current residence.

Include details about your mortgage payment and move-in date (if applicable).

Provide information about your employment status and income.

Specify if you're applying alone, with a co-signer or co-applicant.

Enter details about your assets and debts for a more accurate pre-approval result.

Here’s what some of the steps look like:

Follow-up and Document Submission

Expect a follow-up call from a Homewise advisor to discuss your preferences further and get the process moving. To finalize your application, you'll need to submit key documents, including income confirmation (T4, job letter, or pay stub), credit check authorization, and personal identification.

Now, lets dive into some things you should know about mortgages if you aren’t already aware.

Common Concerns with Pre-Approvals

With this process requiring sensitive information like your credit score and a look into your finances, there are bound to be some concerns. One common concern is the impact on your credit score. While a credit check is part of the pre-approval process, the impact on your credit score is very minimal and does not stay on your credit history for long.

Another concern is the validity period of pre-approvals. Pre-approvals typically remain valid for up to 120 days, giving you enough time to find the right property.

Types of Mortgages

Understanding the types of mortgages available to you is a crucial step that can not only help gauge what the next few years of payments will look like but also help in the decision-making process. There are two main types: Fixed-rate mortgages and Variable-rate mortgages.

Fixed-rate mortgages offer stability, while variable-rate mortgages can lead to potential savings. Each type has its advantages and disadvantages, depending on your financial goals and risk tolerance.

Fixed-Rate Mortgages Offer Stability

Advantages:

Stable Monthly Payments: One of the key advantages of a fixed-rate mortgage is the predictability of monthly payments. Your interest rate remains constant for the entire term of the loan, providing financial stability and making budgeting easier.

Long-Term Planning: Fixed-rate mortgages are ideal for individuals who prioritize long-term financial planning. Knowing that your interest rate won't change allows you to budget confidently for the entire duration of the mortgage.

Protection from Rate Fluctuations: In a rising interest rate environment, fixed-rate mortgages shield you from increased payments, offering peace of mind and financial security.

Disadvantages:

Higher Initial Rates: The trade-off for stability is often a slightly higher initial interest rate compared to variable-rate mortgages. However, this premium assures future rate hikes.

Less Flexibility in Rate Drops: If market interest rates decrease, fixed-rate mortgage holders might miss out on potential savings since their rate remains unchanged.

Variable-Rate Mortgages Offer Potential Savings and Flexibility

Advantages:

Potential Interest Savings: Variable-rate mortgages are tied to a benchmark interest rate, typically the prime rate. In a falling interest rate environment, borrowers can benefit from lower interest costs and potentially save money over the life of the mortgage.

Lower Initial Rates: Variable-rate mortgages often start with lower initial interest rates compared to fixed-rate mortgages, making them attractive to those seeking lower upfront costs.

Flexibility in Rate Drops: If market interest rates decrease, variable-rate mortgage holders can take advantage of lower rates, resulting in decreased monthly payments and potential interest savings.

Disadvantages:

Rate Fluctuations: The primary drawback of variable-rate mortgages is the inherent uncertainty in interest rate fluctuations. Monthly payments can increase if interest rates rise, leading to financial unpredictability.

Budgeting Challenges: For individuals who prefer a stable and predictable budget, the potential for fluctuating interest rates may pose challenges in financial planning.

Choosing Between Closed and Open Mortgages

In addition to the decision between fixed and variable rates, another crucial aspect of your mortgage journey involves selecting between closed and open mortgages.

Closed-term mortgages

Closed-term mortgages are a common choice among homeowners seeking lower interest rates. However, this decision comes with a trade-off – should you wish to renegotiate or pay off the balance before the term concludes, you may have to pay a penalty. Despite this, closed-rate mortgages often come with prepayment options, allowing you to make extra payments without penalties.

Open-rate mortgages

These offer flexibility, making them a great option if you plan to repay your mortgage soon. With open mortgages, you can repay either part or the entire mortgage without worrying about fees. Additionally, converting your mortgage to another term without penalties is a viable option. This flexibility, though advantageous, comes with a cost in the form of higher interest rates.

Amortization Period and Term

Given the nature of mortgages, repayment occurs over an extended period, known as the amortization period. The typical amortization period is around 25 years for most new homeowners, however, there is flexibility to opt for a 30-year period in certain situations. Extending the amortization period reduces monthly payments but results in a higher total interest payment over the mortgage's lifespan.

Your mortgage term defines the duration of your contract with a lender. Although a five-year term is a popular choice, terms can range from one to 10 years.

Payment Frequency Options

When setting up your mortgage, payment frequency options play a pivotal role in determining both the amount and frequency of payments. Your options include:

Monthly: Payments occur once a month.

Bi-weekly: Payments are made twice a month.

Accelerated Bi-weekly: Your monthly payment is divided by two and paid every other week, allowing you to make extra payments and pay off your mortgage faster.

Weekly: Similar to bi-weekly, with payments occurring every week.

Accelerated Weekly: Your monthly payment is divided by four and paid every week.

Carefully considering these payment frequency options allows you to tailor your mortgage structure to your goals and preferences.

Which Mortgage Is Right for You?

For Stability Seekers: If you value financial predictability and plan to stay in your home for an extended period, a fixed-rate mortgage is likely the better choice. This is particularly beneficial in environments with low interest rates.

For Risk-Tolerant Individuals: If you are comfortable with some level of financial uncertainty and believe that interest rates will remain stable or decrease, a variable-rate mortgage might offer potential cost savings, especially in the short to medium term.

Selecting between a fixed-rate and a variable-rate mortgage depends on your risk tolerance, financial goals, and the current economic environment. It's advisable to consult with financial experts or mortgage advisors to assess your specific situation and make an informed decision that aligns with your homeownership objectives. Remember, the right mortgage type contributes significantly to your overall financial well-being and the success of your homeownership journey.

Concluding Thoughts

The journey to homeownership is a stressful one, but securing a mortgage pre-approval is the single most important step that will set the tone for your entire home-buying experience. With Homewise and Chexy by your side, this process becomes easy, quick, and, most importantly–stress-free.

It’s also worth noting that if you’re currently a renter and want to improve your credit score for a better interest rate, consider renting through Chexy. You’ll not only earn rewards that you would have otherwise missed out on, but with the help of the Chexy Credit Builder, you can have your rent payments reported to Equifax, helping you build your credit history and making an impact on your credit score.

House hunting starts with knowing what you can afford, and a pre-approval with HomeWise does just that! It’s time to take your first step in your home-buying journey, so start with HomeWise.

† Terms and Conditions apply.

Disclaimer:

Financial institutions do not pay us for connecting them with customers. We may receive compensation in other ways, such as when someone applies for or is approved for a product. However, we do not receive payment for advertising, and not all products we list result in compensation for us. Advertisers are not responsible for the content on this site, including any editorial or review content that may appear. For complete and current information on any advertiser’s product, please visit their website.

Frequently Asked Questions

Frequently Asked Questions

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?