A Guide to the TD Rewards Program: How to Maximize Your Points

Jan 6, 2026

Written by

Written by

Brianna Harrison (Credit Card & Travel Writer)

Brianna Harrison (Credit Card & Travel Writer)

Table of contents

Title

Title

Title

Are you new to the TD Rewards program and want to learn how it works, or are you looking to get a credit card that will earn you a lot of points? In this guide, we’ll show you how to maximize your earnings and unlock top-tier value from this loyalty program.

Before we dive in, subscribe to The Chexy Rundown for weekly updates, travel and credit card news, and the best flight deals you can book with TD points.

TD Rewards Program–An Overview

TD Rewards is a flexible loyalty program for TD credit cardholders. You can earn points with six of their credit cards and redeem them for travel bookings, statement credits, gift cards, and more–although we recommend redeeming them for travel to get the most out of your points!

No matter your income level, you will probably qualify for one of the TD credit cards and start earning points on all your purchases. The highest level of rewards–travel–is structured around Expedia, one of the biggest travel companies in the world.

If you have a TD credit card, keep reading to find out just how lucrative this rewards program can be.

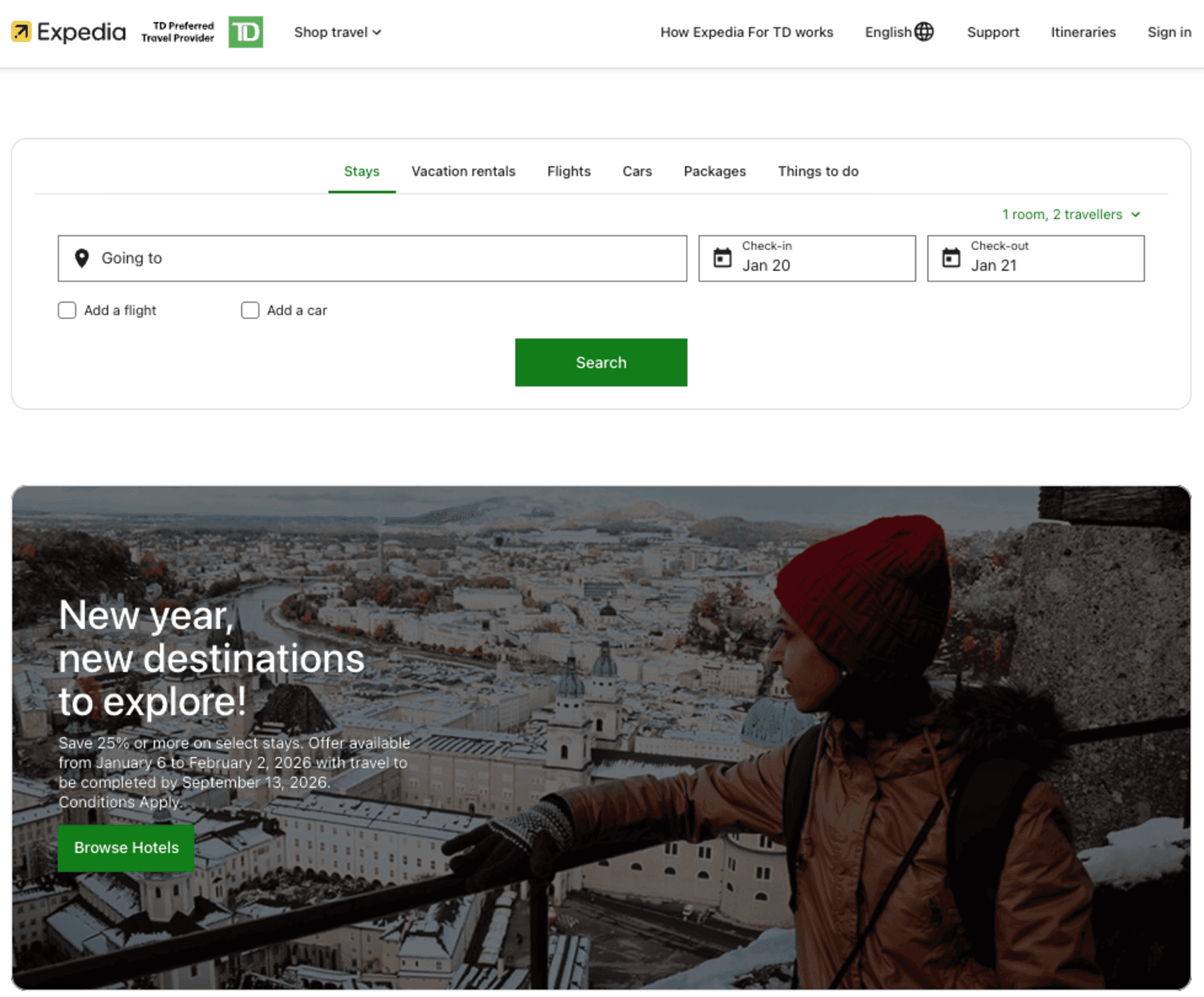

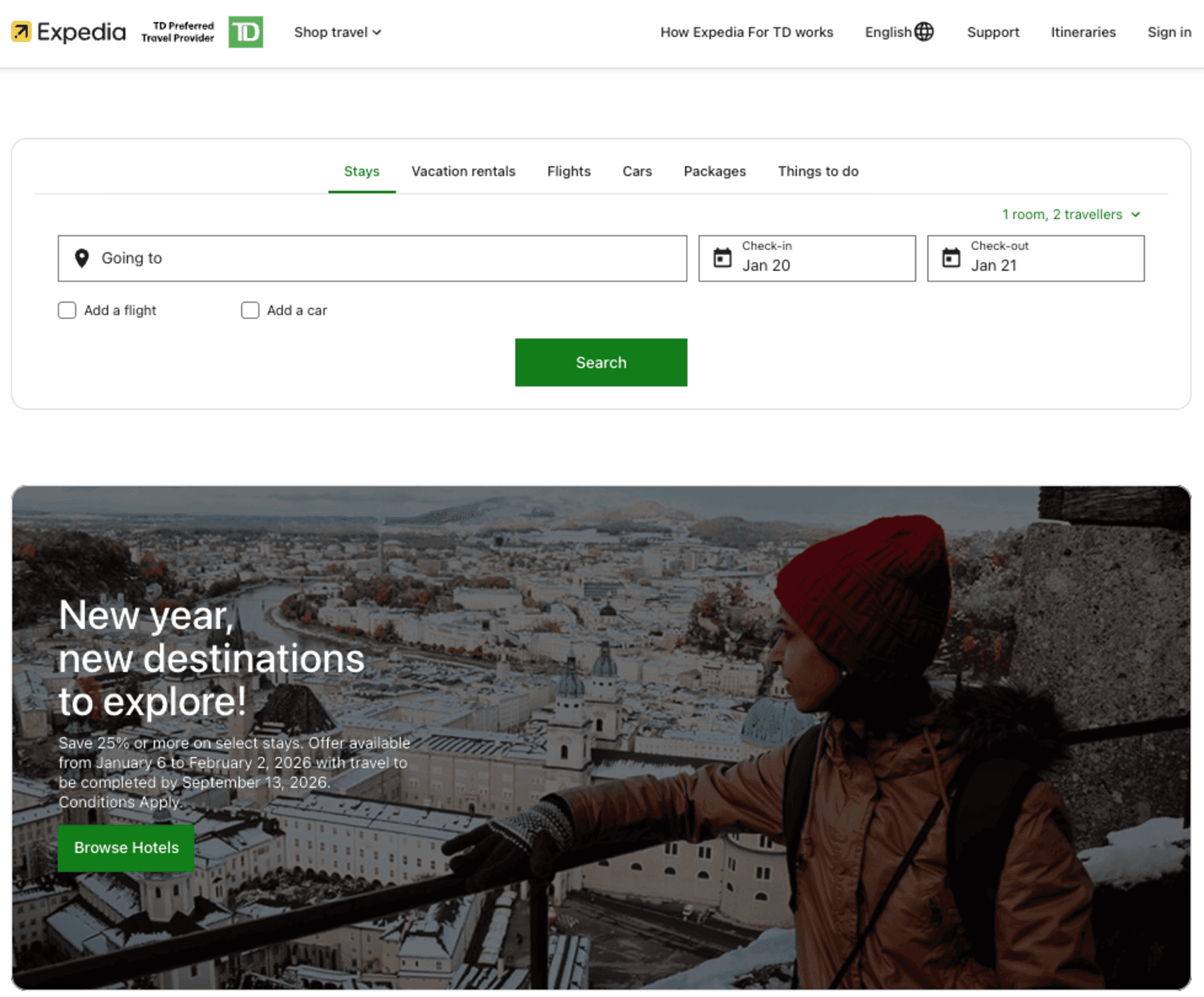

What is Expedia for TD?

Since we mention this quite a bit below, Expedia for TD is your best option for redeeming TD Rewards points. Expedia and TD have partnered to create a travel booking portal where TD members can earn and redeem points and sometimes get exclusive deals. If you’ve used Expedia before (who hasn’t?), you’ll find this site extremely easy to navigate.

Every 200 points are worth $1 off travel purchases, which can include flights, hotels, car rentals, and vacation packages.

To redeem your points for travel, sign into ExpediaForTD.com using your online banking details. Find your ideal trip, then head to the billing page and input the dollar value of points you want to redeem under ‘Use Your TD Rewards Points.”

After completing the booking, your credit card will be charged the full amount, but the dollar value of the points you redeemed will be credited to your account in 3-5 business days.

**Note that Expedia for TD has been designed only for TD members; you cannot earn points by booking directly with Expedia.ca or earn additional points with Expedia’s loyalty program.

How to Earn TD Rewards Points

There is only one way to earn TD Rewards points–with a TD credit card. While six of their credit cards are part of the rewards program, we recommend these top three because of their travel and cashback benefits:

TD First Class Travel Visa Infinite Card†

Best for: The avid traveller who wants all the perks

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

Annual income requirement: $60,000 personal or $100,000 household

The TD First Class Travel Visa Infinite Card† is a top-tier travel rewards credit card. It comes with a bunch of benefits perfect for those who travel often, including:

A $100 annual TD Travel Rewards Credit when you book with Expedia for TD

TD Rewards Birthday bonus points

Shopping and travel insurance coverage, such as medical, trip delay, and lost baggage insurance

Visa Infinite benefits, including concierge service and access to the luxury hotel collection, dining series, and wine country program

With this credit card, every purchase earns you TD Rewards Points. You’ll earn:

8 points for every $1 spent on travel through Expedia for TD

6 points for every $1 spent on groceries, restaurants, and public transit

4 points for every $1 spent on regularly recurring bill payments (like rent!)

2 points for every $1 spent on everything else

An annual Birthday Bonus of up to 10,000 points

Here’s just how many TD Rewards points you could earn using this credit card to pay your rent through Chexy:

Let’s say your rent is $2,000 a month. You earn 4 points for every $1 spent, so you’ll earn 8,000 points per month. In just one year, you’ll have earned 96,000 TD Rewards points–almost enough for a free $500 flight.

Plus, if you apply and get approved for this card, you’ll get one month of fee-free rent with us!

TD Aeroplan Visa Infinite Card†

Best for: Earning points on travel and everyday purchases without the high fees

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

Annual income requirement: $60,000 personal or $100,000 household

Another great choice in TD’s lineup of travel credit cards, the TD Aeroplan Visa Infinite Card† is great for those who still want to earn points and be covered with travel insurance but don’t want to pay a high annual fee.

This credit card doesn’t earn TD Rewards points, but if you travel with Air Canada, this is (in our opinion) one of the best travel credit cards you can get. You earn Aeroplan points on every purchase, as per the following:

1.5 Aeroplan points for every $1 spent on gas, groceries, and Air Canada purchases

1 Aeroplan point for every $1 spent on everything else

Some sweet benefits of this card include:

A free first checked bag for you and up to 8 companions

Reach Aeroplan Elite Status faster

Upgrade to Avis Preferred Plus

Access to the Visa Infinite program benefits

TD Cash Back Visa Infinite Card†

Best for: Flexible cash back redemption + travel and auto perks

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

Annual income requirement: $60,000 personal or $100,000 household

The TD Cash Back Visa Infinite Card† earns you Cash Back Dollars on every single purchase, which can be redeemed for anything TD Rewards points can be, including travel and statement credits. You can earn:

3% Cash Back Dollars on groceries, gas, EV charging, and recurring bill payments

1% Cash Back Dollars on everything else

A great perk of earning cash back with this card is that you can use it to help pay down your account balance any time you want–unlike most other credit cards, which pay out the cashback balance only once a year.

In addition to travel insurance and Visa Infinite benefits, this credit card also includes a free Deluxe TD Auto Club Membership, which means you’re covered 24 hours a day if anything goes wrong when you’re out on the road.

If you don’t meet the income requirements, you can apply for the TD Cash Back Visa Card† instead, which will still earn you Cash Back Dollars, but for no annual fee and at a lower rate.

For the coffee lovers: TD has a partnership with Starbucks, where you can earn 50% more TD Rewards Points and Stars just by linking your TD credit card.

Ways to Redeem TD Rewards Points

Every purchase you make with your TD credit card earns you points, and you have full flexibility in how and when to redeem them. You can use your points in a few different ways, but travel is the best option–which we’ll get into more below.

Expedia for TD

Expedia’s partnership with TD is how you’ll get the most for your points. Every 200 points = $1 off your booking, which can be anything from flights, hotels, car rentals, cruises, and vacation packages.

There are no travel blackouts and no seat restrictions, and your points do not expire as long as your account is open and in good standing.

Book Any Way Travel

This is the second-best way to redeem your TD points, which you can use for almost any travel expense on your credit card. You’ll need to redeem at least 250 points, which gives you $1 off your booking (up to $1,200). You have 90 days from your booking date to use your points.

Statement Credit

This may seem like an easy redemption option, but we don’t recommend it, as you’ll only get half the value as you would when booking travel with Expedia. Each point is worth about 0.25 cents, which means you’ll need a lot of points to get $50 or even $100 off your credit card balance.

Other Ways to Redeem

You can use your TD points at Amazon and Starbucks and to buy gift cards. However, the redemption value is quite low, so we don’t recommend this option either.

How Much Are TD Rewards Points Worth?

TD Rewards points are worth between 0.23 to 0.5 cents per point, depending on what you redeem them for. You’ll get the best value by using them on travel bookings with Expedia for TD.

Here’s a quick glance at the TD Rewards Points value based on what you redeem them for:

Expedia for TD bookings: 0.5 cents per point/redeem 200 points for $1 off

Other travel bookings: 0.4 cents per point on the first $1,200, then 0.5 cents per point after that

Amazon.ca: 0.33 cents per point

Gift cards, merchandise, and statement credit: 0.25 to 0.33 cents per point

As you can see, you’ll get the most out of your points by redeeming them for travel (like many other loyalty programs!).

How to Maximize the TD Rewards Program

By far, the best way to maximize the TD Rewards program and get the most out of your points is by booking travel through Expedia for TD. This is the highest value for your points, at 0.5 cents per point. You can earn and redeem the most amount of points this way–let’s put it into perspective:

When booking travel on Expedia for TD, you can redeem 200 points for $1 off. Let your points balance get up to 100k, and you’ll get a $500 travel credit!

Another way to maximize this rewards program is to look out for credit card welcome bonuses that can give you over 100,000 points in less than a year. For example, at the time of writing, you can earn a bonus of 165,000 points in your first year of using the TD First Class Travel Visa Infinite Card.

Don’t forget about the shopping and travel insurance coverage these cards offer, either. Take advantage of these perks if you ever need them.

And lastly, one of the best ways to maximize the TD Rewards program is by using your TD credit card on large recurring expenses–like rent. If you use the TD First Class Travel Visa Infinite Card, you’ll earn 4 points for every dollar spent on rent and recurring payments. It’s an easy way to earn enough points which you can redeem for a free vacation (in a few months!).

What are you waiting for? Get started with Chexy today and start earning rewards on your rent and bill payments.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

What are TD Rewards Birthday Bonus points?

Some TD credit cards reward you with “Birthday Bonus” points. These points are for the primary cardholder and equal 10% of the total number of points you’ve earned over the past year, up to a maximum of 10,000 points.

Does TD give you a free Uber One subscription?

Previously, TD and Uber One teamed up to give some cardholders a free 6- or 12-month subscription to Uber One. However, this is no longer the case.

Can I transfer my TD points to another person?

TD points cannot be transferred to another person or another loyalty program (unlike Aeroplan).

† Terms and Conditions apply.

Are you new to the TD Rewards program and want to learn how it works, or are you looking to get a credit card that will earn you a lot of points? In this guide, we’ll show you how to maximize your earnings and unlock top-tier value from this loyalty program.

Before we dive in, subscribe to The Chexy Rundown for weekly updates, travel and credit card news, and the best flight deals you can book with TD points.

TD Rewards Program–An Overview

TD Rewards is a flexible loyalty program for TD credit cardholders. You can earn points with six of their credit cards and redeem them for travel bookings, statement credits, gift cards, and more–although we recommend redeeming them for travel to get the most out of your points!

No matter your income level, you will probably qualify for one of the TD credit cards and start earning points on all your purchases. The highest level of rewards–travel–is structured around Expedia, one of the biggest travel companies in the world.

If you have a TD credit card, keep reading to find out just how lucrative this rewards program can be.

What is Expedia for TD?

Since we mention this quite a bit below, Expedia for TD is your best option for redeeming TD Rewards points. Expedia and TD have partnered to create a travel booking portal where TD members can earn and redeem points and sometimes get exclusive deals. If you’ve used Expedia before (who hasn’t?), you’ll find this site extremely easy to navigate.

Every 200 points are worth $1 off travel purchases, which can include flights, hotels, car rentals, and vacation packages.

To redeem your points for travel, sign into ExpediaForTD.com using your online banking details. Find your ideal trip, then head to the billing page and input the dollar value of points you want to redeem under ‘Use Your TD Rewards Points.”

After completing the booking, your credit card will be charged the full amount, but the dollar value of the points you redeemed will be credited to your account in 3-5 business days.

**Note that Expedia for TD has been designed only for TD members; you cannot earn points by booking directly with Expedia.ca or earn additional points with Expedia’s loyalty program.

How to Earn TD Rewards Points

There is only one way to earn TD Rewards points–with a TD credit card. While six of their credit cards are part of the rewards program, we recommend these top three because of their travel and cashback benefits:

TD First Class Travel Visa Infinite Card†

Best for: The avid traveller who wants all the perks

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

Annual income requirement: $60,000 personal or $100,000 household

The TD First Class Travel Visa Infinite Card† is a top-tier travel rewards credit card. It comes with a bunch of benefits perfect for those who travel often, including:

A $100 annual TD Travel Rewards Credit when you book with Expedia for TD

TD Rewards Birthday bonus points

Shopping and travel insurance coverage, such as medical, trip delay, and lost baggage insurance

Visa Infinite benefits, including concierge service and access to the luxury hotel collection, dining series, and wine country program

With this credit card, every purchase earns you TD Rewards Points. You’ll earn:

8 points for every $1 spent on travel through Expedia for TD

6 points for every $1 spent on groceries, restaurants, and public transit

4 points for every $1 spent on regularly recurring bill payments (like rent!)

2 points for every $1 spent on everything else

An annual Birthday Bonus of up to 10,000 points

Here’s just how many TD Rewards points you could earn using this credit card to pay your rent through Chexy:

Let’s say your rent is $2,000 a month. You earn 4 points for every $1 spent, so you’ll earn 8,000 points per month. In just one year, you’ll have earned 96,000 TD Rewards points–almost enough for a free $500 flight.

Plus, if you apply and get approved for this card, you’ll get one month of fee-free rent with us!

TD Aeroplan Visa Infinite Card†

Best for: Earning points on travel and everyday purchases without the high fees

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

Annual income requirement: $60,000 personal or $100,000 household

Another great choice in TD’s lineup of travel credit cards, the TD Aeroplan Visa Infinite Card† is great for those who still want to earn points and be covered with travel insurance but don’t want to pay a high annual fee.

This credit card doesn’t earn TD Rewards points, but if you travel with Air Canada, this is (in our opinion) one of the best travel credit cards you can get. You earn Aeroplan points on every purchase, as per the following:

1.5 Aeroplan points for every $1 spent on gas, groceries, and Air Canada purchases

1 Aeroplan point for every $1 spent on everything else

Some sweet benefits of this card include:

A free first checked bag for you and up to 8 companions

Reach Aeroplan Elite Status faster

Upgrade to Avis Preferred Plus

Access to the Visa Infinite program benefits

TD Cash Back Visa Infinite Card†

Best for: Flexible cash back redemption + travel and auto perks

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

Annual income requirement: $60,000 personal or $100,000 household

The TD Cash Back Visa Infinite Card† earns you Cash Back Dollars on every single purchase, which can be redeemed for anything TD Rewards points can be, including travel and statement credits. You can earn:

3% Cash Back Dollars on groceries, gas, EV charging, and recurring bill payments

1% Cash Back Dollars on everything else

A great perk of earning cash back with this card is that you can use it to help pay down your account balance any time you want–unlike most other credit cards, which pay out the cashback balance only once a year.

In addition to travel insurance and Visa Infinite benefits, this credit card also includes a free Deluxe TD Auto Club Membership, which means you’re covered 24 hours a day if anything goes wrong when you’re out on the road.

If you don’t meet the income requirements, you can apply for the TD Cash Back Visa Card† instead, which will still earn you Cash Back Dollars, but for no annual fee and at a lower rate.

For the coffee lovers: TD has a partnership with Starbucks, where you can earn 50% more TD Rewards Points and Stars just by linking your TD credit card.

Ways to Redeem TD Rewards Points

Every purchase you make with your TD credit card earns you points, and you have full flexibility in how and when to redeem them. You can use your points in a few different ways, but travel is the best option–which we’ll get into more below.

Expedia for TD

Expedia’s partnership with TD is how you’ll get the most for your points. Every 200 points = $1 off your booking, which can be anything from flights, hotels, car rentals, cruises, and vacation packages.

There are no travel blackouts and no seat restrictions, and your points do not expire as long as your account is open and in good standing.

Book Any Way Travel

This is the second-best way to redeem your TD points, which you can use for almost any travel expense on your credit card. You’ll need to redeem at least 250 points, which gives you $1 off your booking (up to $1,200). You have 90 days from your booking date to use your points.

Statement Credit

This may seem like an easy redemption option, but we don’t recommend it, as you’ll only get half the value as you would when booking travel with Expedia. Each point is worth about 0.25 cents, which means you’ll need a lot of points to get $50 or even $100 off your credit card balance.

Other Ways to Redeem

You can use your TD points at Amazon and Starbucks and to buy gift cards. However, the redemption value is quite low, so we don’t recommend this option either.

How Much Are TD Rewards Points Worth?

TD Rewards points are worth between 0.23 to 0.5 cents per point, depending on what you redeem them for. You’ll get the best value by using them on travel bookings with Expedia for TD.

Here’s a quick glance at the TD Rewards Points value based on what you redeem them for:

Expedia for TD bookings: 0.5 cents per point/redeem 200 points for $1 off

Other travel bookings: 0.4 cents per point on the first $1,200, then 0.5 cents per point after that

Amazon.ca: 0.33 cents per point

Gift cards, merchandise, and statement credit: 0.25 to 0.33 cents per point

As you can see, you’ll get the most out of your points by redeeming them for travel (like many other loyalty programs!).

How to Maximize the TD Rewards Program

By far, the best way to maximize the TD Rewards program and get the most out of your points is by booking travel through Expedia for TD. This is the highest value for your points, at 0.5 cents per point. You can earn and redeem the most amount of points this way–let’s put it into perspective:

When booking travel on Expedia for TD, you can redeem 200 points for $1 off. Let your points balance get up to 100k, and you’ll get a $500 travel credit!

Another way to maximize this rewards program is to look out for credit card welcome bonuses that can give you over 100,000 points in less than a year. For example, at the time of writing, you can earn a bonus of 165,000 points in your first year of using the TD First Class Travel Visa Infinite Card.

Don’t forget about the shopping and travel insurance coverage these cards offer, either. Take advantage of these perks if you ever need them.

And lastly, one of the best ways to maximize the TD Rewards program is by using your TD credit card on large recurring expenses–like rent. If you use the TD First Class Travel Visa Infinite Card, you’ll earn 4 points for every dollar spent on rent and recurring payments. It’s an easy way to earn enough points which you can redeem for a free vacation (in a few months!).

What are you waiting for? Get started with Chexy today and start earning rewards on your rent and bill payments.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

What are TD Rewards Birthday Bonus points?

Some TD credit cards reward you with “Birthday Bonus” points. These points are for the primary cardholder and equal 10% of the total number of points you’ve earned over the past year, up to a maximum of 10,000 points.

Does TD give you a free Uber One subscription?

Previously, TD and Uber One teamed up to give some cardholders a free 6- or 12-month subscription to Uber One. However, this is no longer the case.

Can I transfer my TD points to another person?

TD points cannot be transferred to another person or another loyalty program (unlike Aeroplan).

† Terms and Conditions apply.

Disclaimer:

Financial institutions do not pay us for connecting them with customers. We may receive compensation in other ways, such as when someone applies for or is approved for a product. However, we do not receive payment for advertising, and not all products we list result in compensation for us. Advertisers are not responsible for the content on this site, including any editorial or review content that may appear. For complete and current information on any advertiser’s product, please visit their website.

Frequently Asked Questions

Frequently Asked Questions

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?