A Guide to Tenant Insurance in Canada: Do You Actually Need It?

13 nov. 2024

Written by

Written by

Brianna Harrison (Credit Card & Travel Writer)

Brianna Harrison (Credit Card & Travel Writer)

Table of contents

Title

Title

Title

If you’re a renter in Canada, you’ve probably heard about tenant insurance, but what exactly does it cover, and do you really need it? Hint: It’s more useful than you might think!

Tenant insurance is an affordable yet important safety net that covers you and your stuff from break-ins, damages, and liabilities. In this guide, we’ll break down what it covers, how it works, and why it’s worth considering for peace of mind in your new apartment.

In this article, we use the terms renters insurance and tenant insurance interchangeably, as they are the same thing!

New to renting in Canada? Check out these helpful articles:

What is Renter’s Insurance?

Renter’s insurance, also called tenant insurance, is an insurance policy that covers you in the event of damage or loss to your personal property. Essentially, if someone breaks into your home or there is a disaster such as a flood, you will get money back to replace your personal belongings (like your furniture, clothing, and electronics).

Tenant insurance also covers you if someone gets hurt while on your property and they decide to sue you or if you cause accidental damage to the property, such as starting a fire.

Renters insurance is generally quite affordable and is great to have, as it protects you from large, unexpected costs. Typically, your landlord’s insurance will only cover the building itself, not your personal items.

What Does Renters Insurance Cover?

Tenant insurance generally covers three things:

1. Personal belongings: This includes all of your personal items, like your clothing, furniture, appliances, and electronic devices. You’ll get your money back if your stuff gets stolen, ruined by a flood, or damaged by a fire.

2. Liability: You’re covered if someone accidentally gets hurt in your rental and you’re considered responsible, or if you accidentally damage the property.

3. Living expenses: If something happens to your rental unit and you’re unable to live there for a while, tenant insurance may also help cover the cost of accommodation and food.

What Does Renters Insurance NOT Cover?

The range of coverage depends on your insurance policy, but generally, renters insurance does not cover the following:

Unique and expensive personal items: Certain valuables, like gold, jewelry, antiques, and expensive electronics, may not be covered if they are valued more than what the insurance company is willing to pay out.

Your roommate’s personal items: Only your personal belongings are covered, not your roommates’ or anyone else who lives in the rental.

Damage to the building: The structure of the building (roof, walls, floors) is covered by the landlord’s insurance, not yours.

Natural disasters like floods and earthquakes: Most renter's insurance policies won’t cover damage from natural disasters. You might want to look into a separate policy if you live in a high-risk area.

Pest infestations: Pests like bed bugs, rodents, and termites are not covered by renters insurance; they are the landlord’s problem to deal with.

Car theft or damage: Your personal belongings inside the car (like your laptop or phone) might be covered by your policy, but the actual vehicle is not. You’ll need to get car insurance for that.

How Does Tenant Insurance Work?

Tenant insurance gives you financial protection for your belongings, liability, and living expenses in exchange for regular monthly payments, called premiums. Here’s how it works:

1. Buy a policy. Choose a policy that fits your needs. It outlines exactly what’s covered and how much coverage you have for each category. You’ll pay a premium (either monthly or annually), which essentially keeps your policy active.

2. You are protected. Tenant insurance protects your personal belongings, provides liability coverage, and covers additional living expenses, as outlined above.

3. You experience a loss and file a claim. If something happens to your rental, such as a burglary, fire, or flood, you file a claim with the insurance company, requesting compensation for the loss or damage.

4. You pay the deductible. When filing the claim, you’ll pay the deductible, which is the amount you agree to pay upfront before your policy kicks in. For example, if your deductible is $500 and you file a claim for $3,000, you will pay the first $500, and the insurance company will pay the remaining $2,500.

5. The insurance company pays the rest. They will look at your claim. Based on your policy, they will pay you for your losses up to the coverage limit (the maximum they will pay for your claim).

Essentially, renters insurance works by paying small amounts each month (a premium). If something bad happens, the insurance will cover most of it after you pay your share (the deductible) up to a certain amount (the coverage limit).

Here’s an example of how it works:

Let’s say your renter's insurance policy covers up to $25,000 in personal property and includes liability and additional living expenses. You pay $15 monthly as a premium, and your deductible is $500.

Your apartment gets flooded, and you need to leave for a few days until it dries out. It caused damage to your laptop and a few other personal belongings, valued at about $2,000.

You file a claim with the insurance company for $2,000. You’ll need to pay $500 first, and the insurance covers the remaining $1,500. They also help pay for temporary housing under additional living expenses.

How Much Does Renters Insurance Cost?

The cost of renters insurance in Canada is usually between $15 to $35 per month or about $180 to $420 annually. A few factors that can influence the cost include:

Location: If you live in a big city like Toronto or Vancouver, you’re more likely to pay more than in a smaller city.

Coverage amount: The more personal items you want to insure, the higher your premium. Most policies offer coverage from $20,000 to $30,000, but you can adjust this number.

Deductible: Your premium will be lower if you choose a higher deductible (meaning you pay more out of pocket).

Liability coverage: Most providers include $1 to $2 million in liability coverage, but you can opt for a higher amount, which can increase the cost.

Do You Actually Need Tenant Insurance in Canada?

While tenant insurance is not mandatory, it’s a great thing to have just in case something happens to your rental unit (fingers crossed it won’t, though!). Many people don’t have renters insurance, especially students or newcomers to Canada who’d rather spend their money on other necessities, but it is important to consider.

Some landlords do require their tenants to get insurance, however. If they do, you need to get it. This requirement should be outlined in your lease agreement, and you should discuss it with your landlord before signing.

To answer the question, “Do I need renters insurance?” ask yourself if you would have enough money to cover the cost of a worst-case scenario. Let’s say your apartment flooded when you were away and completely damaged your expensive laptop, clothing, kitchen appliances, and furniture you worked so hard to afford. Replacing all of this could add up to more than $5,000. Now, that’s a lot of money to pay out of pocket. If you have tenant insurance, you likely won’t pay more than $25 monthly for peace of mind.

How to Choose the Best Tenant Insurance Policy

When looking for a renters insurance policy, you’ll want to consider three main things:

Coverage: Make sure it includes the coverage you need. Most policies cover the basics (personal items, liability, and living expenses), but you may need additional coverage for expensive electronics, jewelry, or identity theft.

Deductible: Your deductible directly impacts your premium. If you want to pay a smaller monthly premium, you’ll need to pay a larger deductible, and vice versa. Think about how much you can afford to pay out of pocket for unexpected expenses.

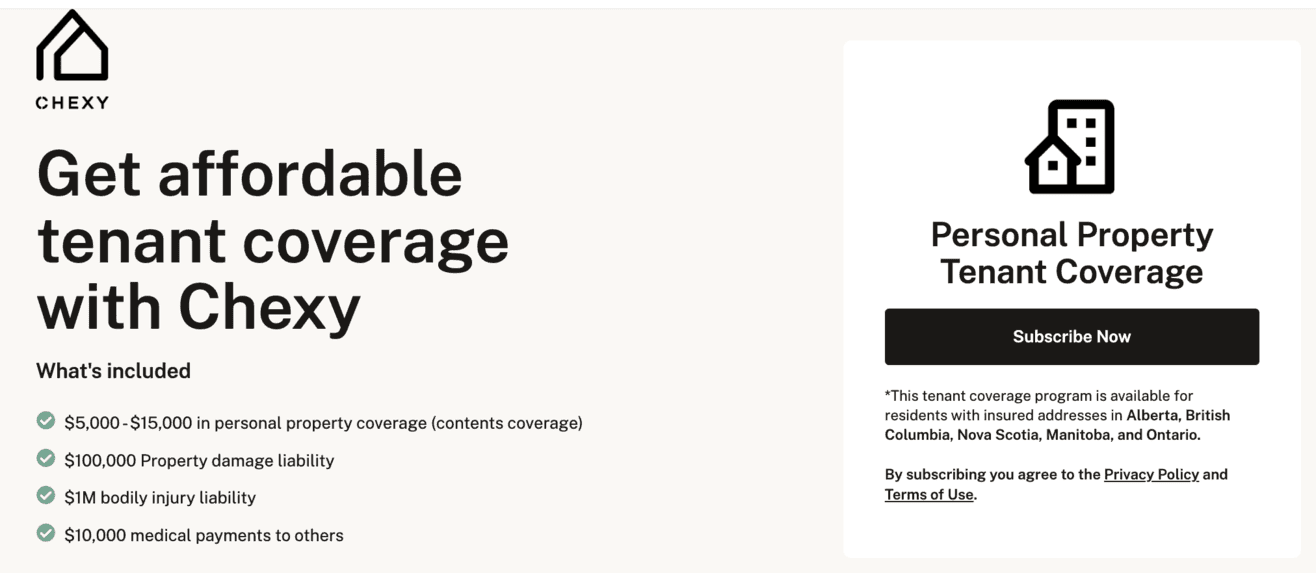

Savings options: Some tenant insurance policies allow you to bundle with your other types of insurance or bills. If you rent with Chexy and get Walnut tenant insurance, you can bundle it with your rent and phone bill, saving you up to 0.30% on Chexy fees.

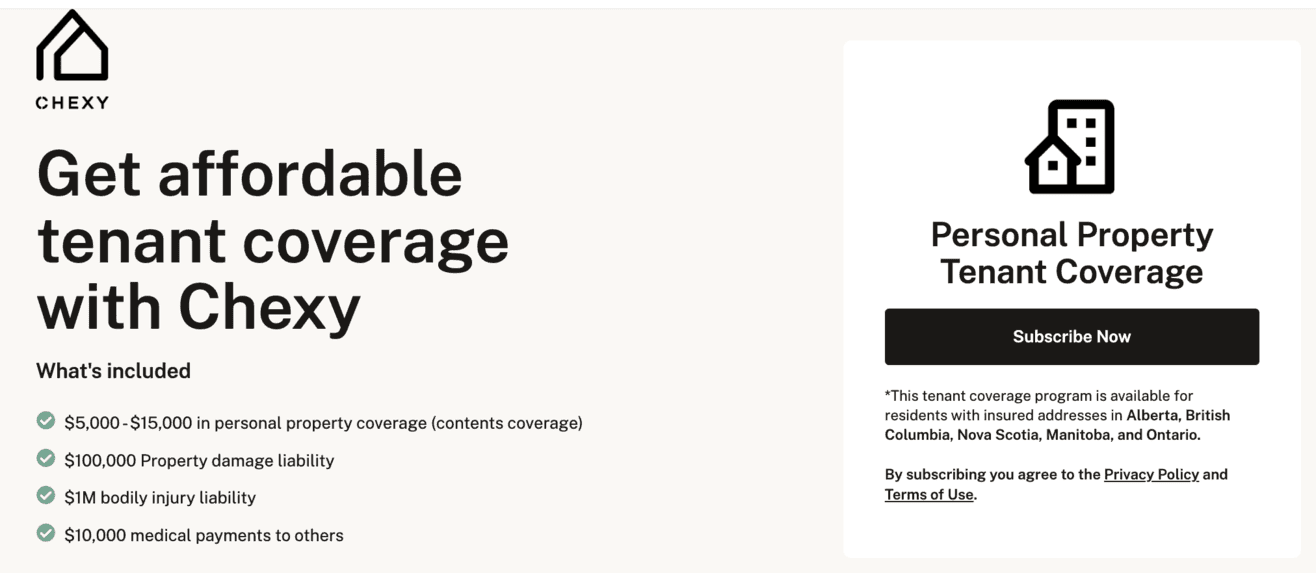

How to Get a Tenant Coverage Quote

Let’s take a look at how you can get tenant insurance coverage with Walnut Insurance, a top provider in Canada. They search for different insurance providers in your area and choose the best option for you. Here’s how you can get a quote and how much it will cost:

Note that Walnut is only available in Alberta, British Columbia, Nova Scotia, Manitoba, and Ontario. If you live outside those provinces, you can find great cheap renters insurance policies from providers like Square One, Duuo, and Apollo. Always do your research to find the best coverage for you.

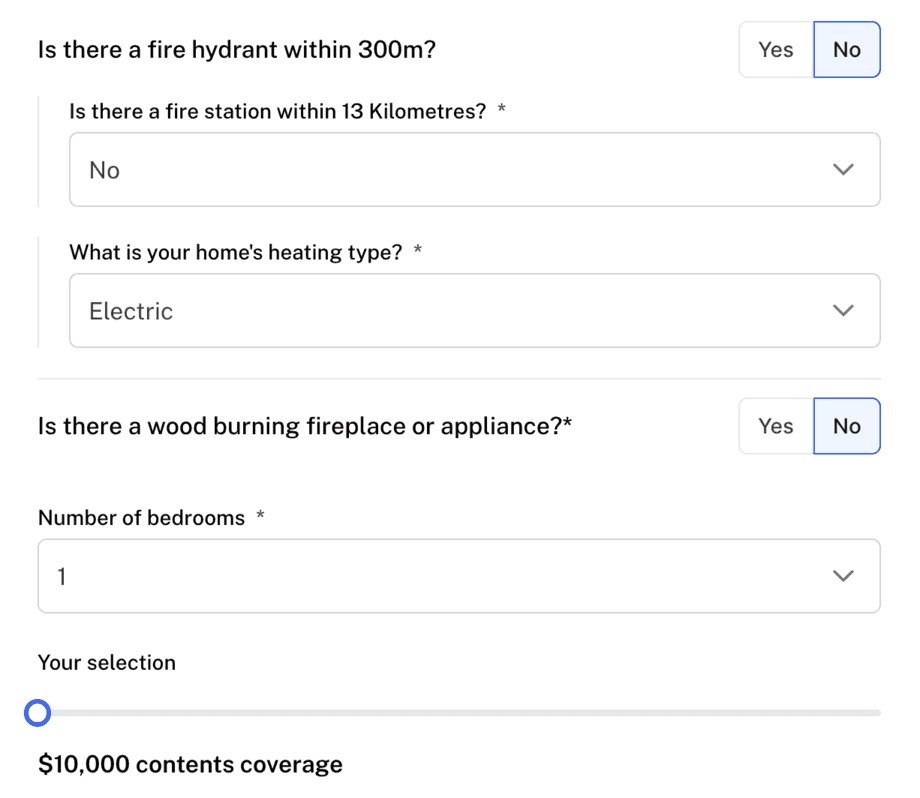

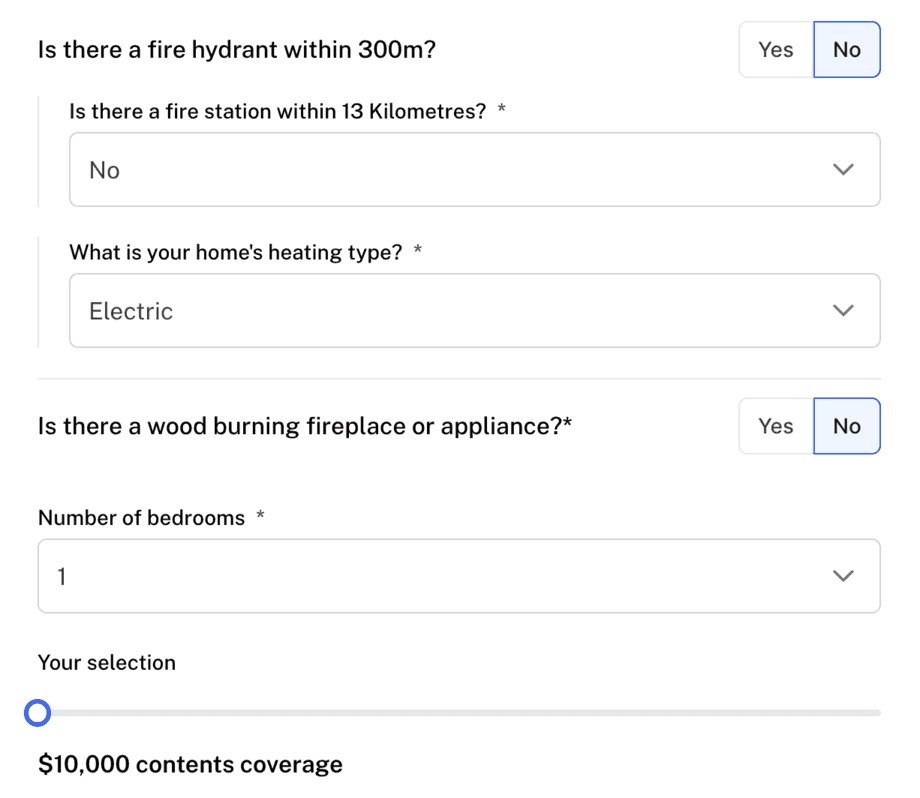

In this example, we live in a high-rise building in Toronto. It is a one-bedroom with electric heating, and we have not previously had tenant insurance.

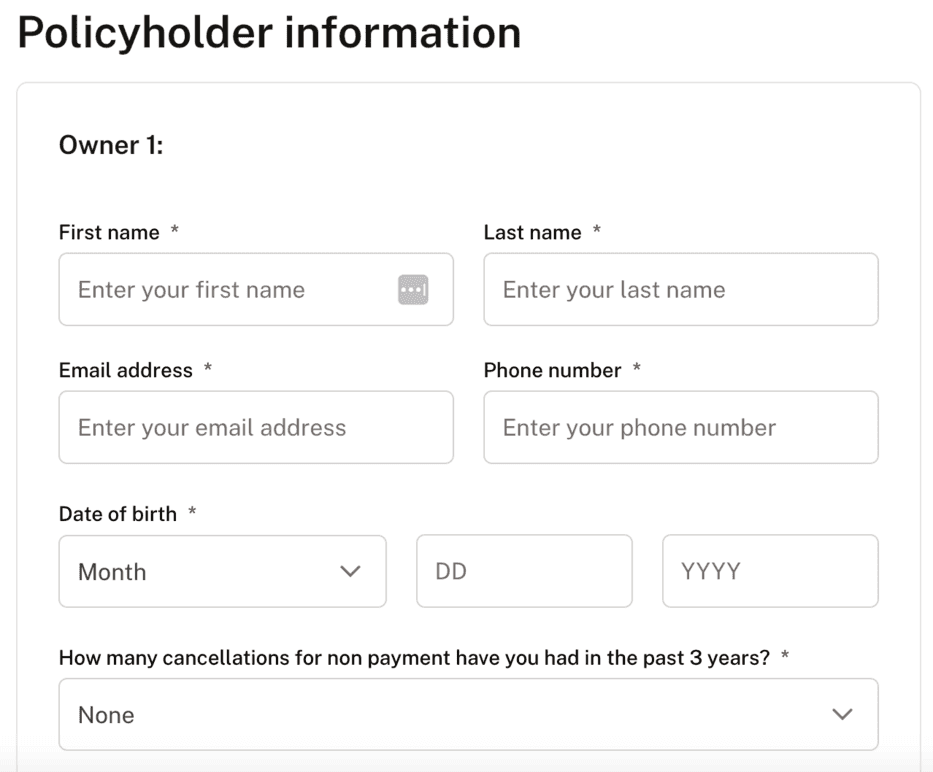

To get a quote, follow these simple steps:

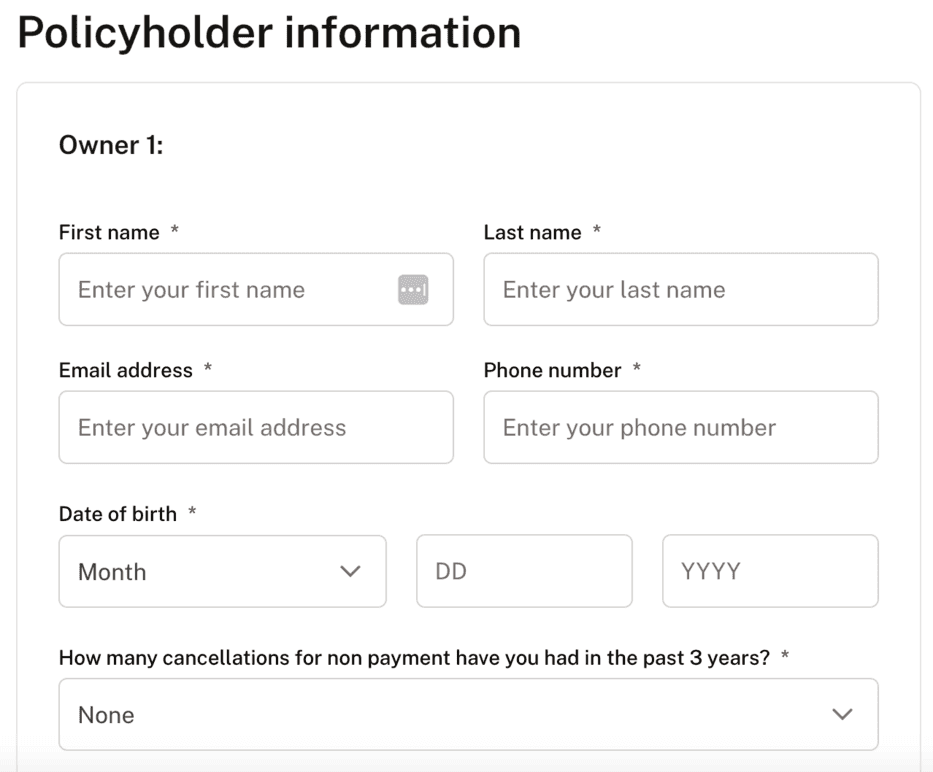

1. Fill out your personal information, such as name, email address, date of birth, and residential address.

2. Answer a few more questions, including if you’re a smoker, have had tenant insurance in the past five years, how your home is heated, and how much contents coverage you want. For this example, we said $10,000.

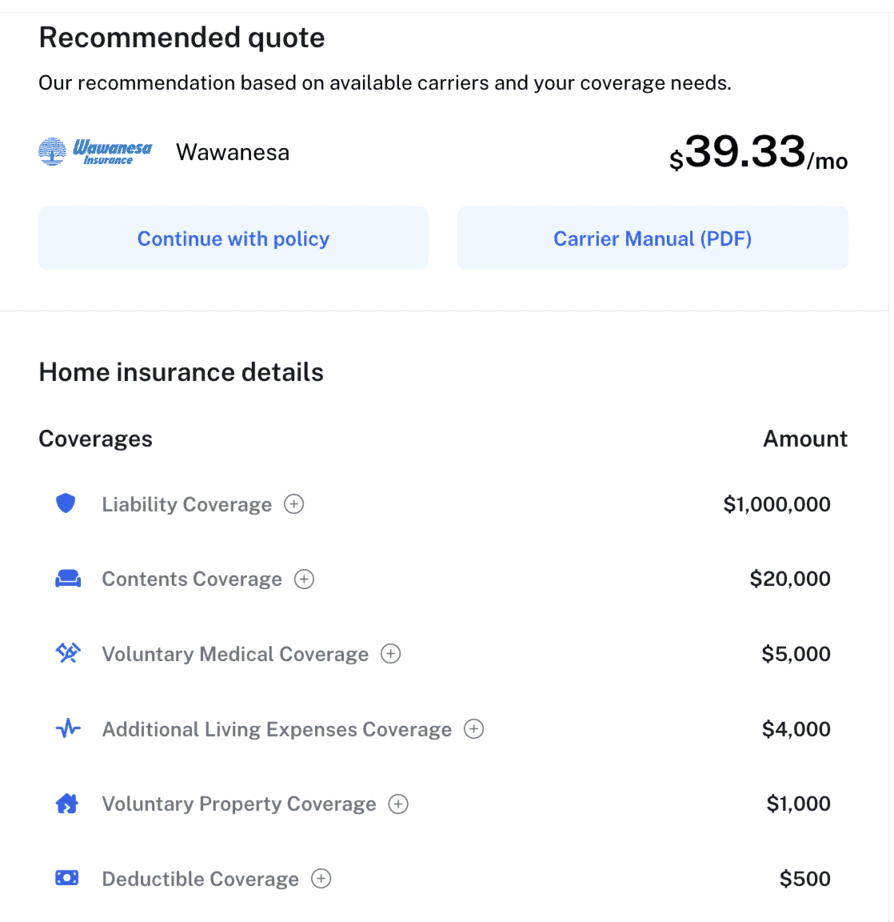

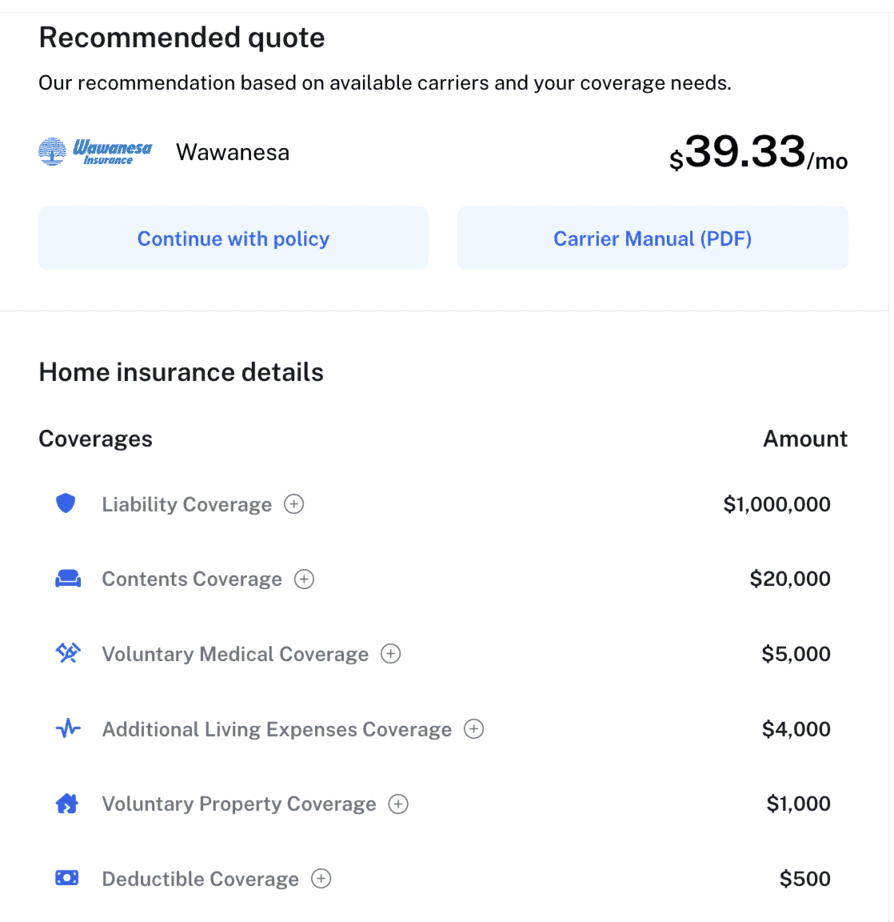

3. You’ll get a recommended quote based on available carriers and your coverage needs. We got a quote for $39.33 per month, with a $500 deductible and $1M liability amount.

And that’s it! Walnut has one of the simplest processes for getting a quote–in just a few clicks, you’ll see how much you could pay each month and exactly what the insurance includes.

If you’re a renter looking for tenant insurance, check out Walnut for affordable tenant coverage with Chexy. Why not double dip on your savings? You’ll earn rewards on your rent payments and save money on Chexy fees while having peace of mind with insurance coverage.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

Can a landlord demand renters insurance?

You are not legally obligated to get tenant insurance, but your landlord may require you to get it. If it is in your lease agreement, they have the legal right to request proof of insurance. Anyways, it’s better to have it and be safe than sorry!

How much tenant insurance do I need?

You need at least enough insurance to cover your personal belongings. For example, if you own $8,000 worth of stuff, you should get renters insurance with at least $8,000 of coverage for your personal belongings. You might also want to consider getting additional liability coverage and medical coverage.

Is tenant insurance mandatory in BC?

Tenant insurance is not mandatory in BC or any other province in Canada, but your landlord may require you to have it.

† Terms and Conditions apply.

If you’re a renter in Canada, you’ve probably heard about tenant insurance, but what exactly does it cover, and do you really need it? Hint: It’s more useful than you might think!

Tenant insurance is an affordable yet important safety net that covers you and your stuff from break-ins, damages, and liabilities. In this guide, we’ll break down what it covers, how it works, and why it’s worth considering for peace of mind in your new apartment.

In this article, we use the terms renters insurance and tenant insurance interchangeably, as they are the same thing!

New to renting in Canada? Check out these helpful articles:

What is Renter’s Insurance?

Renter’s insurance, also called tenant insurance, is an insurance policy that covers you in the event of damage or loss to your personal property. Essentially, if someone breaks into your home or there is a disaster such as a flood, you will get money back to replace your personal belongings (like your furniture, clothing, and electronics).

Tenant insurance also covers you if someone gets hurt while on your property and they decide to sue you or if you cause accidental damage to the property, such as starting a fire.

Renters insurance is generally quite affordable and is great to have, as it protects you from large, unexpected costs. Typically, your landlord’s insurance will only cover the building itself, not your personal items.

What Does Renters Insurance Cover?

Tenant insurance generally covers three things:

1. Personal belongings: This includes all of your personal items, like your clothing, furniture, appliances, and electronic devices. You’ll get your money back if your stuff gets stolen, ruined by a flood, or damaged by a fire.

2. Liability: You’re covered if someone accidentally gets hurt in your rental and you’re considered responsible, or if you accidentally damage the property.

3. Living expenses: If something happens to your rental unit and you’re unable to live there for a while, tenant insurance may also help cover the cost of accommodation and food.

What Does Renters Insurance NOT Cover?

The range of coverage depends on your insurance policy, but generally, renters insurance does not cover the following:

Unique and expensive personal items: Certain valuables, like gold, jewelry, antiques, and expensive electronics, may not be covered if they are valued more than what the insurance company is willing to pay out.

Your roommate’s personal items: Only your personal belongings are covered, not your roommates’ or anyone else who lives in the rental.

Damage to the building: The structure of the building (roof, walls, floors) is covered by the landlord’s insurance, not yours.

Natural disasters like floods and earthquakes: Most renter's insurance policies won’t cover damage from natural disasters. You might want to look into a separate policy if you live in a high-risk area.

Pest infestations: Pests like bed bugs, rodents, and termites are not covered by renters insurance; they are the landlord’s problem to deal with.

Car theft or damage: Your personal belongings inside the car (like your laptop or phone) might be covered by your policy, but the actual vehicle is not. You’ll need to get car insurance for that.

How Does Tenant Insurance Work?

Tenant insurance gives you financial protection for your belongings, liability, and living expenses in exchange for regular monthly payments, called premiums. Here’s how it works:

1. Buy a policy. Choose a policy that fits your needs. It outlines exactly what’s covered and how much coverage you have for each category. You’ll pay a premium (either monthly or annually), which essentially keeps your policy active.

2. You are protected. Tenant insurance protects your personal belongings, provides liability coverage, and covers additional living expenses, as outlined above.

3. You experience a loss and file a claim. If something happens to your rental, such as a burglary, fire, or flood, you file a claim with the insurance company, requesting compensation for the loss or damage.

4. You pay the deductible. When filing the claim, you’ll pay the deductible, which is the amount you agree to pay upfront before your policy kicks in. For example, if your deductible is $500 and you file a claim for $3,000, you will pay the first $500, and the insurance company will pay the remaining $2,500.

5. The insurance company pays the rest. They will look at your claim. Based on your policy, they will pay you for your losses up to the coverage limit (the maximum they will pay for your claim).

Essentially, renters insurance works by paying small amounts each month (a premium). If something bad happens, the insurance will cover most of it after you pay your share (the deductible) up to a certain amount (the coverage limit).

Here’s an example of how it works:

Let’s say your renter's insurance policy covers up to $25,000 in personal property and includes liability and additional living expenses. You pay $15 monthly as a premium, and your deductible is $500.

Your apartment gets flooded, and you need to leave for a few days until it dries out. It caused damage to your laptop and a few other personal belongings, valued at about $2,000.

You file a claim with the insurance company for $2,000. You’ll need to pay $500 first, and the insurance covers the remaining $1,500. They also help pay for temporary housing under additional living expenses.

How Much Does Renters Insurance Cost?

The cost of renters insurance in Canada is usually between $15 to $35 per month or about $180 to $420 annually. A few factors that can influence the cost include:

Location: If you live in a big city like Toronto or Vancouver, you’re more likely to pay more than in a smaller city.

Coverage amount: The more personal items you want to insure, the higher your premium. Most policies offer coverage from $20,000 to $30,000, but you can adjust this number.

Deductible: Your premium will be lower if you choose a higher deductible (meaning you pay more out of pocket).

Liability coverage: Most providers include $1 to $2 million in liability coverage, but you can opt for a higher amount, which can increase the cost.

Do You Actually Need Tenant Insurance in Canada?

While tenant insurance is not mandatory, it’s a great thing to have just in case something happens to your rental unit (fingers crossed it won’t, though!). Many people don’t have renters insurance, especially students or newcomers to Canada who’d rather spend their money on other necessities, but it is important to consider.

Some landlords do require their tenants to get insurance, however. If they do, you need to get it. This requirement should be outlined in your lease agreement, and you should discuss it with your landlord before signing.

To answer the question, “Do I need renters insurance?” ask yourself if you would have enough money to cover the cost of a worst-case scenario. Let’s say your apartment flooded when you were away and completely damaged your expensive laptop, clothing, kitchen appliances, and furniture you worked so hard to afford. Replacing all of this could add up to more than $5,000. Now, that’s a lot of money to pay out of pocket. If you have tenant insurance, you likely won’t pay more than $25 monthly for peace of mind.

How to Choose the Best Tenant Insurance Policy

When looking for a renters insurance policy, you’ll want to consider three main things:

Coverage: Make sure it includes the coverage you need. Most policies cover the basics (personal items, liability, and living expenses), but you may need additional coverage for expensive electronics, jewelry, or identity theft.

Deductible: Your deductible directly impacts your premium. If you want to pay a smaller monthly premium, you’ll need to pay a larger deductible, and vice versa. Think about how much you can afford to pay out of pocket for unexpected expenses.

Savings options: Some tenant insurance policies allow you to bundle with your other types of insurance or bills. If you rent with Chexy and get Walnut tenant insurance, you can bundle it with your rent and phone bill, saving you up to 0.30% on Chexy fees.

How to Get a Tenant Coverage Quote

Let’s take a look at how you can get tenant insurance coverage with Walnut Insurance, a top provider in Canada. They search for different insurance providers in your area and choose the best option for you. Here’s how you can get a quote and how much it will cost:

Note that Walnut is only available in Alberta, British Columbia, Nova Scotia, Manitoba, and Ontario. If you live outside those provinces, you can find great cheap renters insurance policies from providers like Square One, Duuo, and Apollo. Always do your research to find the best coverage for you.

In this example, we live in a high-rise building in Toronto. It is a one-bedroom with electric heating, and we have not previously had tenant insurance.

To get a quote, follow these simple steps:

1. Fill out your personal information, such as name, email address, date of birth, and residential address.

2. Answer a few more questions, including if you’re a smoker, have had tenant insurance in the past five years, how your home is heated, and how much contents coverage you want. For this example, we said $10,000.

3. You’ll get a recommended quote based on available carriers and your coverage needs. We got a quote for $39.33 per month, with a $500 deductible and $1M liability amount.

And that’s it! Walnut has one of the simplest processes for getting a quote–in just a few clicks, you’ll see how much you could pay each month and exactly what the insurance includes.

If you’re a renter looking for tenant insurance, check out Walnut for affordable tenant coverage with Chexy. Why not double dip on your savings? You’ll earn rewards on your rent payments and save money on Chexy fees while having peace of mind with insurance coverage.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

Can a landlord demand renters insurance?

You are not legally obligated to get tenant insurance, but your landlord may require you to get it. If it is in your lease agreement, they have the legal right to request proof of insurance. Anyways, it’s better to have it and be safe than sorry!

How much tenant insurance do I need?

You need at least enough insurance to cover your personal belongings. For example, if you own $8,000 worth of stuff, you should get renters insurance with at least $8,000 of coverage for your personal belongings. You might also want to consider getting additional liability coverage and medical coverage.

Is tenant insurance mandatory in BC?

Tenant insurance is not mandatory in BC or any other province in Canada, but your landlord may require you to have it.

† Terms and Conditions apply.

Disclaimer:

Frequently Asked Questions

Frequently Asked Questions

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?