How to Apply for a Rental in Canada: A Step-By-Step Guide

Dec 31, 2025

Table of contents

Title

Are you ready to embark on the search for a rental but don’t know where to start? Applying for an apartment or condo can seem complicated, but we’re here to simplify it. We’ll break down exactly what steps to take when applying for a new rental, plus give you some tips on securing your dream home.

Read our comprehensive guide on everything you need to know about renting in Canada and your rights as a tenant.

Following these steps will help you succeed with the rental application process.

Before You Apply for a Rental Property

Check Your Credit Score

Check your credit report before applying or even looking at rental units. Knowing your credit score is important, as landlords use it to determine your eligibility for a rental.

If you have a poor credit score (below 560) or an unestablished credit history, you may be unable to rent your dream apartment.

You can check your credit score for free via your bank, or through Equifax, TransUnion, or Borrowell.

Can I apply for a rental with a bad or no credit history?

If you have a poor credit score, you can appoint a guarantor with good credit to co-sign the lease. The guarantor will legally take responsibility for paying the rent if you fail to do so.

A guarantor can be anyone you trust, like a friend or family member.

Determine Your Budget

Once you’ve checked your credit score, you’ll need to create a budget to ensure you can pay your rent every month.

A popular guideline called the “30% rule” essentially states that you should spend 30% of your income on rent. Some people also use the 50/30/20 budget, which divides your income into needs (50%), wants (30%), and savings (20%).

Of course, we all know that this isn’t the economy anymore since rent prices are so high, so adjust the guidelines to fit your budget. You might need to put 50% or 60% of your income towards rent and needs, and the rest for wants and savings. Create a budget that works for you, and stick to it. Discipline is key here.

Spending 30% to 75% of your income on rent is the harsh reality, so it’s best you make the most of your large rent payments by earning rewards on them with Chexy.

Remember to account for moving expenses, security deposit, and first and last month’s rent in your budget for the first month. Those expenses along with your wifi, phone bill, and tenant insurance can be expensive, but if you bundle them with Chexy, you can save some money on the monthly fee.

Decide Where You Want To Live

After creating your budget, the next important (but fun!) aspect of searching for a rental is deciding where to live. Research different neighborhoods in the city and compare the prices and atmosphere of each.

For example, in Toronto, you could live in the artsy Queen West, the cultural hotspot of Little Italy, or the bohemian Kensington Market.

Generally, the closer to downtown, the more expensive the rent. However, sometimes paying more rent is worth it for the close access to amenities such as grocery stores, schools, and restaurants.

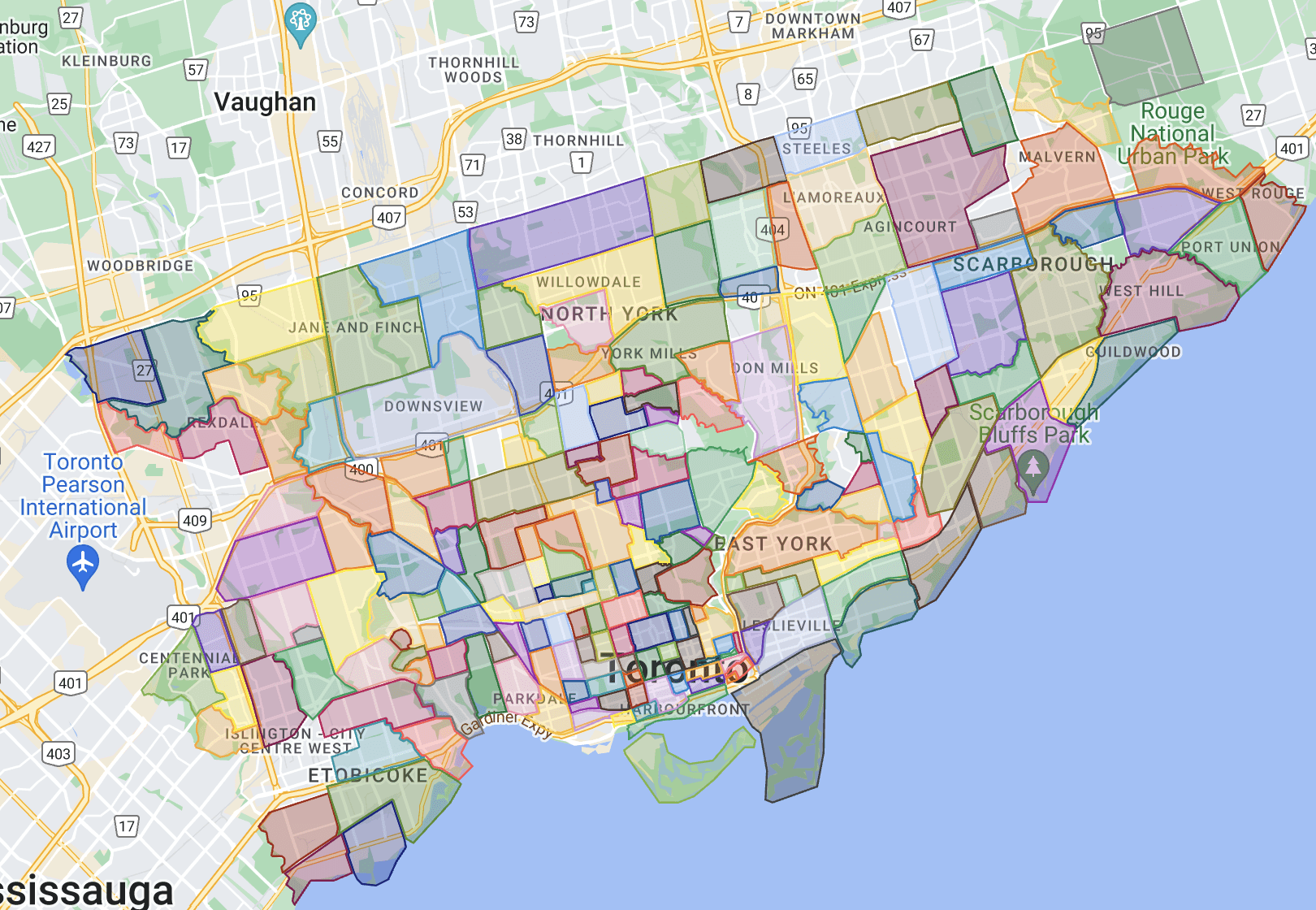

A map of Toronto's 158 neighbourhoods

Types of Rental Properties

The three most common types of property to rent in Canada are:

Condo: A privately owned unit in a condominium complex. It sometimes has amenities like a concierge, workout room, common areas, and a pool.

Apartment: A residential unit part of one or several buildings. Apartments are generally cheaper than condos but don’t come with many amenities.

House: Perfect rentals for newcomers, families, and roommates. It can be a great option for those looking to split the rent.

How to Find a Rental Property

Rental listing websites are the best way to find a rental property in Canada. On these sites, you can search for the type of rental you’re looking for and filter by price, neighbourhood, and other important factors.

Some of our top recommendations for the best apartment and condo rental websites include:

During the Application Process

Organize Essential Documents

You’ll need these important documents to prove you can afford your rent and pay it on time:

Employment letter

Credit report

Proof of income and bank statements

References from previous landlords or trusted friends/family/colleagues

Photo ID

Note: The landlord can ask for your Social Insurance Number, but you do not have to legally provide it, as they don’t need it to run a credit check. The Ontario Human Rights Code section 4.2.5 outlines this.

Fill Out and Submit Your Application

Before renting an apartment, you’ll need to fill out a form for the rental application, which gives landlords the information they need to assess you as a potential tenant. This form will ask you about your contact information, employment history, and rental experience.

Here are some examples of rental application forms in Canada. Some are province-wide, while others are specific to a city:

Here's some more info on the rental application form in Ontario.

After You Apply for a Rental Property

Secure Your Unit and Sign the Lease Agreement

A lease agreement in Canada is a legal document that outlines the terms you and your landlord have agreed to. It will include things like:

The amount of rent you will be paying monthly

How you can pay the rent (i.e. e-transfer, cheque, pre-authorized debit)

The dates of your apartment lease

Rules surrounding the rental (i.e. pets, smoking, parties, parking)

How you can cancel or end your lease

If you can sublet and how to do so

Which damages and repairs are your responsibility

How to renew or extend the lease or what happens at the end of the lease

Here’s what the tenancy agreement for each province looks like:

Nunavut (rental office)

Ensure you take the time to read and understand the lease, as it is legally binding.

Prepare To Move In

Here’s a sample timeline for what you should do when preparing to move:

Six weeks to one month before moving:

Order moving boxes

Ask friends and family to help you move or hire movers

Record the dimensions of your new place to ensure your furniture will fit

Sort through your stuff – determine what you’ll be bringing with you and what you want to get rid of

Pack and label your boxes

Change your address on legal documents

Cancel or transfer services like internet, cable, phone, and tenant insurance

Two weeks before moving:

Take time off work for the move

Confirm the date and time of the move with the moving company

A few days before moving:

Check when you’ll receive the keys to your new place

Double-check how many boxes you have and when the movers will arrive

Empty your fridge as much as possible

Ensure parking is available for the moving truck

Plan to move over your home phone, wifi, and all other utilities to the new place

On moving day:

Get possession of the new place and inspect it

Move all of your things in

Check out our ultimate moving checklist for a more comprehensive guide.

Tips for Finding a Rental in Canada

Finding an apartment or condo to rent in Canada can be difficult, but here are a few tips on finding your dream space:

If you’re moving to a new city or province and don’t have a job, ensure you have enough money in your bank account to cover more than a few months of rent. This will show the landlord that you are reliable. Otherwise, finding a guarantor is another viable option.

Research the local rental market to ensure you’re not getting scammed or paying a higher price than other units in the area. For average rent prices, browse websites like Facebook Marketplace, Zumper, and rentals.ca.

Lastly, be as quick and responsive as you can. Since there will likely be many people competing for the same unit, be speedy in your communication with the landlord or agent. Ads are posted every day, and usually, the person who responds and submits an application the quickest will secure the unit.

The Rental Market in Canada

The rental market in Canada is quite high, especially in big cities like Vancouver and Toronto. To give you an idea, the average rent price for a one-bedroom in Vancouver is $2,407, and $2,222 in Toronto (as of December 2025).

However, average asking rent prices have declined 3.1% year-over-year, marking the lowest level since June 2023. This could mean lower rent prices across the country over time.

Despite high listing prices, you can try to negotiate your rent with the landlord. If you pay rent through your credit card with Chexy, you can earn rewards and build your credit with monthly rental payments.

We’ve set you up for success by giving you a step-by-step guide, tips, and tricks for applying for a rental property in Canada.

Once you’ve found the perfect apartment, why not earn rewards on your monthly rent payments? With Chexy, you can build credit and earn rewards and cashback simply by paying your rent with a credit card.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

FAQs

What is the GST/HST new residential rental property rebate?

The GST/HST new residential rental property rebate application is a rebate for the landlord who paid the GST or HST tax on the property.

To qualify for this rebate, the fair market value on the residential unit must be less than $450,000, or $112,500 for land or a site in a residential trailer park. You can read more about this rebate here.

Are bills included in rent in Canada?

Some bills, like heating and water, may be included in your monthly rent. However, some landlords may require you to pay utilities separately. Discuss with your landlord before signing an apartment lease to ensure you’re both on the same page. You can also pay bills with your credit card and earn rewards with Chexy to help offset the high rent prices.

Do you need tenant insurance to rent an apartment?

Tenant’s insurance is not legally required in Canada; however, your landlord may prefer you to have it. If it is a condition in your lease, you must get renters insurance.

† Terms and Conditions apply.

Disclaimer:

Financial institutions do not pay us for connecting them with customers. We may receive compensation in other ways, such as when someone applies for or is approved for a product. However, we do not receive payment for advertising, and not all products we list result in compensation for us. Advertisers are not responsible for the content on this site, including any editorial or review content that may appear. For complete and current information on any advertiser’s product, please visit their website.

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?