How to Pay Rent With a Credit Card in Canada: A Complete Guide

Dec 30, 2025

Table of contents

Title

With the high rent prices in Canada, you’re probably looking for ways to make your biggest monthly expense work for you. You already use your credit card for groceries, travel, and other big purchases–so why not use it for rent, too?

Paying rent with a credit card isn’t just convenient; it can help you earn rewards like cashback, points, or miles and even build your credit score. In this guide, we’ll walk you through everything you need to know to make paying rent with your credit card a smart financial move and how you can do so with Chexy.

Can You Pay Rent With a Credit Card in Canada?

Paying rent with a credit card isn’t typically an option for most renters in Canada—landlords and property managers rarely accept it directly. However, with Chexy, you can finally use your credit card to pay your rent, earn rewards, and even build your credit score.

Chexy is a rent and bill payment platform that lets you pay rent using a credit card, allowing you to unlock valuable rewards like cashback, travel points, or airline miles. Over time, these perks can help you get free flights, upgrade your travel experience, or cover some grocery bills.

While Chexy does charge a small transaction fee, it’s significantly lower than most other payment platforms. With the Chexy Rewards Calculator, you can easily compare various credit cards to see how much value you could earn in rewards.

The Bottom Line?

If you’re still paying rent through Interac e-Transfer, pre-authorized debit, Bill Pay, cash, or cheque, you’re leaving money on the table. Chexy lets you transform one of your largest monthly expenses into an opportunity to earn rewards by paying with your credit card.

How to Pay Rent With a Credit Card in Canada

With Chexy, you can use a Canadian or international credit card to pay your rent. All you need to do is sign up for Chexy and input your details and credit card information. Your rent payments will automatically be charged to your card each month and sent to your landlord on rent day.

Here’s a step-by-step guide on how to pay rent with your credit card using Chexy:

1. Head to chexy.co and sign up using your email address or Google account.

2. Go through the verification process and set up your rent payments by heading to the “Setup Rent Payments” tab in your account.

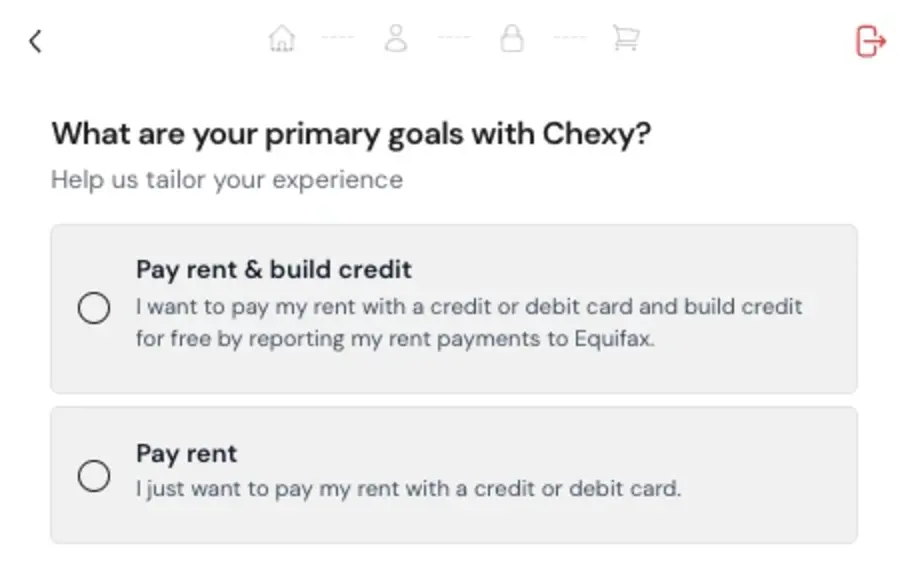

3. Decide whether you want to pay rent and build credit or simply pay rent. If you choose “Pay rent & build credit,” you’ll opt into Chexy’s Credit Builder, which can help increase your credit score by reporting your timely rent payments to Equifax.

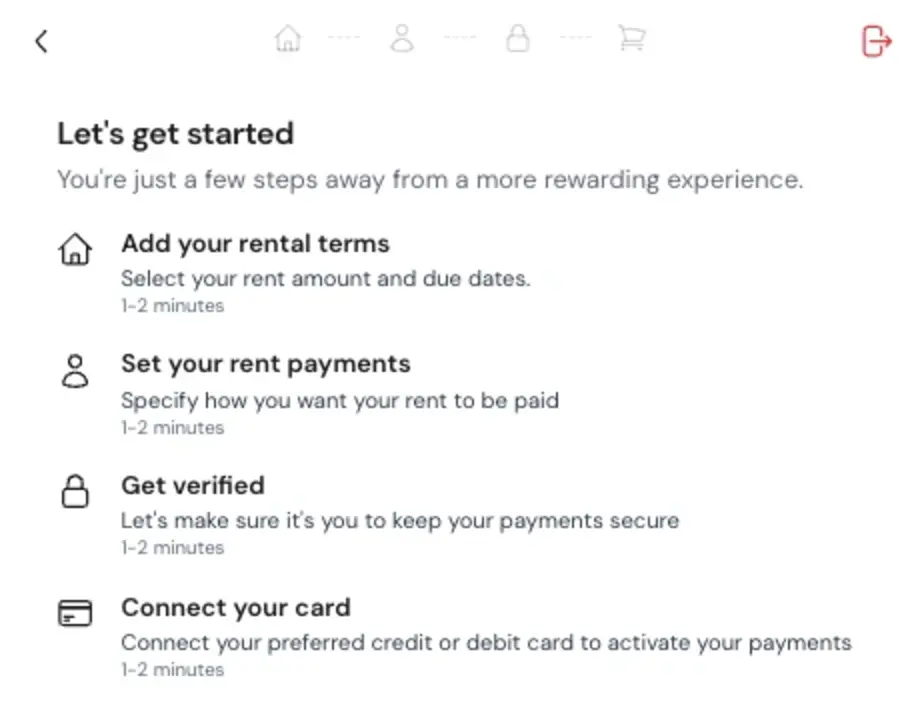

4. Here’s an overview of the signup process:

As you can see, you’ll need to include information such as:

Your monthly rent and due date

How you want your rent to be paid to your landlord (e-Transfer or pre-authorized debit)

Verify your identity and lease agreement

Connect your credit card

Here’s how Chexy works when you’re all set up:

1. Chexy charges your credit card 4 business days before rent is due.

2. On rent day, the funds will automatically be sent to your landlord via Interac e-Transfer, Bill Pay, or they can withdraw via pre-authorized debit (depending on which payment method you set up).

3. Once the payment has been processed and is no longer pending on your credit card, you earn rewards or cash back.

If you apply for a new credit card through Chexy, you can get the 1.75% processing fee waived for one month!

Real-Life Examples of Earning Rewards on Rent

Let’s say your monthly rent is $2,000. Here are a few examples of how much cash back or points you could earn with Chexy:

Earn 4% cash back with the Scotia Momentum Visa Infinite Card:

This card earns you 4% cashback up to $25,000 yearly. With a monthly rent of $2,000, you’ll earn $960 cashback annually.

Excluding the Chexy and annual fees, you’ll get $540 in net cashback per year.

Earn 1.25 points per dollar with the RBC Avion Visa Infinite Privilege Card:

This card earns you 1.25x Avion points per dollar on all purchases. With a monthly rent of $2,000, you’ll earn 30,000 Aeroplan points, equivalent to about $600.

Excluding the Chexy and annual fees, you’ll get $180 in net rent rewards per year.

To help you decide which credit cards to use with Chexy, check out the Chexy Rewards Calculator.

Pros and Cons of Paying Rent With a Credit Card

Here are the key benefits and few drawbacks of paying rent with a credit card:

Pros:

Earn Rewards: You can collect rewards like cashback, points, or miles on your rent payments. Some credit cards even offer bonus points for recurring payment categories.

Build Your Credit: Opt into the Chexy Credit Builder to report your rent payments to Equifax, one of Canada’s major credit bureaus. Plus, simply using your credit card for rent can help build your credit—just be sure to pay off your statement balance in full every month.

Pay Bills with Your Credit Card: When you pay rent with Chexy, you can also pay bills with your credit card using Chexy Bills.

Flexible Payment Options: Your landlord can receive rent payments through Interac e-Transfer, Bill Pay, or pre-authorized debit, ensuring seamless transactions.

Automatic Payments: Set it and forget it! Once Chexy is set up, we will automatically charge your card and send the rent payment to your landlord on the due date.

No Landlord Involvement: Your landlord doesn’t need to register or complete any verification steps.

Cons:

Transaction Fees: Chexy charges a fee of 1.75% for Amex and Visa cards and 2.5% for international cards. However, the rewards earned with premium credit cards outweigh these fees.

Potential Impact on Your Credit Score: If you don’t pay off your credit card balance in full each month, you’ll accrue interest, which can negatively affect your credit score.

Best Credit Cards to Pay Rent With

These are our top picks for the best credit cards to pay rent in Canada. They’ll earn you cashback or points you can turn into free flights:

Scotia Momentum Visa Infinite Card

Best for: Earning cashback on groceries and recurring payments

Annual fee: $120

The Scotia Momentum Visa Infinite Card earns you 4% cash back on up to $25,000 per year. If you have a monthly rent of $2,000, you’ll earn $960 cashback.

Plus, you can earn 2% back on gas and daily transit, and 1% on everything else.

TD Cash Back Visa Infinite Card †

Best for: Earning cashback on groceries, gas & recurring bills

$139 annual fee 21.99% purchase APR 22.99% cash advance APR

The TD Cash Back Visa Infinite Card† gets you 3% cash back on grocery and gas purchases, and regularly recurring bill payments (including rent!), up to a maximum of $15,000. After that, you’ll earn 1% cash back on everything.

Let’s say your rent is $2,000; you’ll earn $540 back each year.

American Express Aeroplan Reserve Card

Best for: Earning Aeroplan points for Air Canada flights

Annual fee: $599

With the American Express Aeroplan Reserve Card, you can earn 1.25x Aeroplan points on all your purchases, including rent. If your rent is $2,000 a month, you’ll earn 30k Aeroplan points on rent alone.

Booking Air Canada travel with this card will get you 3x the points per dollar, and dining & food delivery purchases will get you 2x the points.

Besides this incredible points earning structure, you get many Air Canada and travel benefits, such as airport lounge access, priority airport treatment, and a range of travel insurance coverage.

Is Paying Rent With a Credit Card Worth It?

Paying rent with a credit card can be a game-changer—if you do it right.

First, ensure your rewards outweigh the fees. For example, paying $2,000 monthly rent with the TD Aeroplan Visa Infinite Privilege Card earns you 30,000 Aeroplan points annually, valued at about $210 in travel rewards after Chexy’s 1.75% fee. Choose a card that offers at least 2% back in rewards to make it worthwhile.

Welcome bonuses can also add significant value. For example, the Scotiabank Platinum American Express Card offers up to 80,000 Scene+ points if you hit the spending requirement—easily done by paying rent through Chexy.

Finally, always pay off your credit card balance in full each month to avoid interest charges that could cancel out your rewards. With responsible use, credit cards can help you build credit, earn valuable perks, and turn your rent payments into real benefits.

In short, if you use a rewards card that offsets the fees and maintain good spending habits, paying rent with a credit card through Chexy is absolutely worth it.

Subscribe to our newsletter below for up-to-date credit card, travel, and rental content.

† Terms and Conditions apply.

Disclaimer:

Financial institutions do not pay us for connecting them with customers. We may receive compensation in other ways, such as when someone applies for or is approved for a product. However, we do not receive payment for advertising, and not all products we list result in compensation for us. Advertisers are not responsible for the content on this site, including any editorial or review content that may appear. For complete and current information on any advertiser’s product, please visit their website.

How does Chexy help me earn rewards?

How does Chexy pay my bills?

How much does Chexy cost?

What credit cards does Chexy accept?